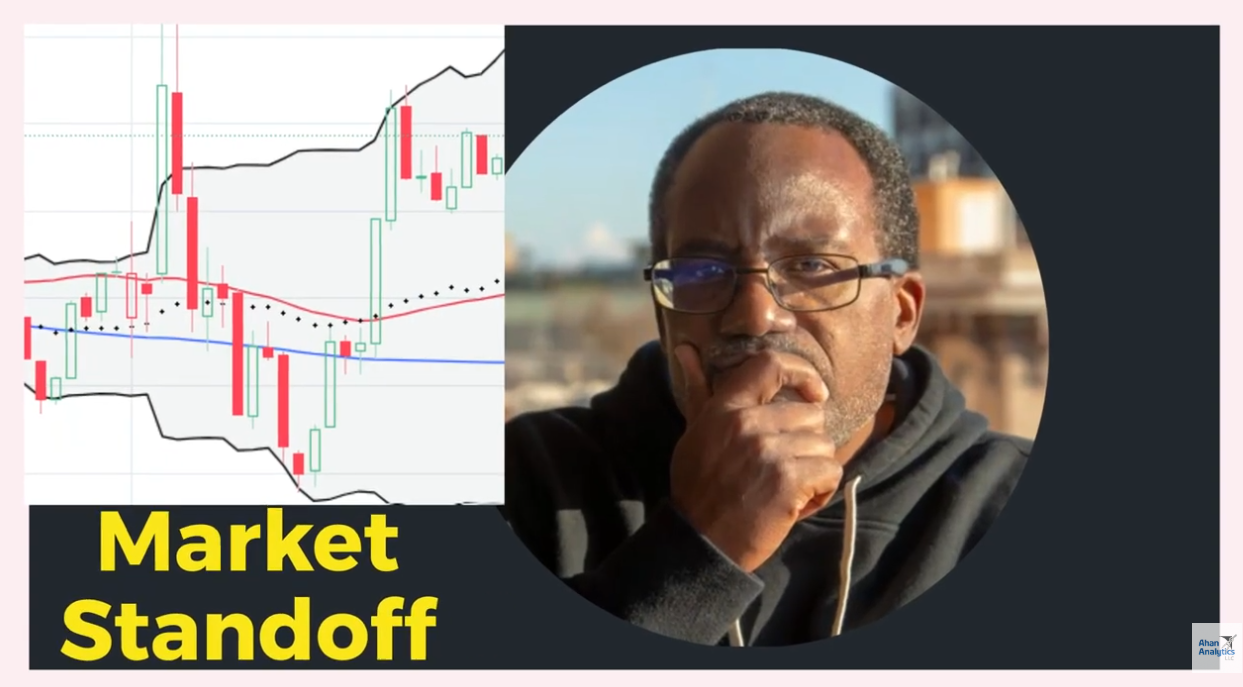

Tariff Showdown: Buyers, Sellers at a Stalemate – The Market Breadth

The Market Breadth Summary Stock Market Commentary The Supreme Court finally issued a judgement on the President’s tariffs enacted under the cover of the International Economic Emergency Powers Act (IEEPA). In a 6-3 decision, the court invalidated the tariffs thus making them illegal. The news came first thing Friday morning and injected a little bit … Read more