The Follow-Through Intro

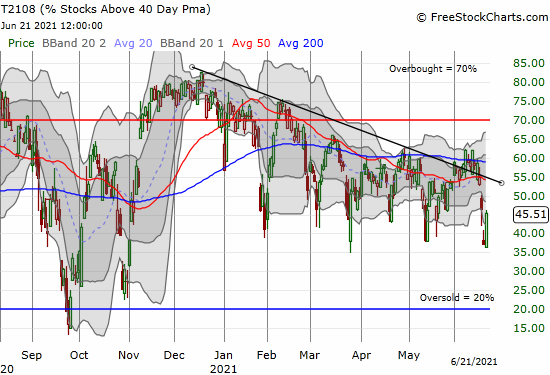

The stock market followed a rare stumble with a broad-based rebound from “oversold enough” conditions. Stocks were generally up across the board as buyers rushed in to grab “bargains.” AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), jumped from 37% to 46%. My favorite technical indicator put on hold any notion that oversold conditions would appear right around the corner. Sellers faded and buyers celebrated. The constant beating on market breadth still suggests that oversold conditions are coming. As a result, I am assuming for now that subsequent market rallies will fizzle into churn and chop, perhaps with an upward bias for key segments of the stock market.

See below for the video covering the follow-through trades.

Stocks and Indices Covered

- S&P 500 (SPY)

- Nasdaq (COMPQX)

- iShares Trust Russell 2000 Index ETF (IWM)

- volatility index (VIX)

- AGNC Investment Corp (AGNC)

- Allegheny Technologies Incorporated (ATI)

- Applied Materials (AMAT)

- Australian dollar vs Japanese yen (AUD/JPY)

- Best Buy (BBY)

- BHP Group Limited (BHP)

- Corning Incorporated (GLW)

- DoorDash (DASH)

- Financial Select Sector SPDR Fund (XLF)

- Illinois Tool Works Inc. (ITW)

- iShares Silver Trust ETF (SLV)

- iShares Trust Russell 200 Index ETF (IWM)

- Lennar Corp. (LEN)

- Maxar Technologies (MAXR)

- Meritor Inc. (MTOR)

- Nike (NKE)

- SPDR Gold Trust (GLD)

- The Mosaic Company (MOS)

- Winnebago Industries (WGO)

Be careful out there!

Full disclosure: long GLD, long SLV call spread and short puts, long MAXR, long GLW, short AUD/JPY

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!