A Moment of Truth for Stocks of Homebuilders

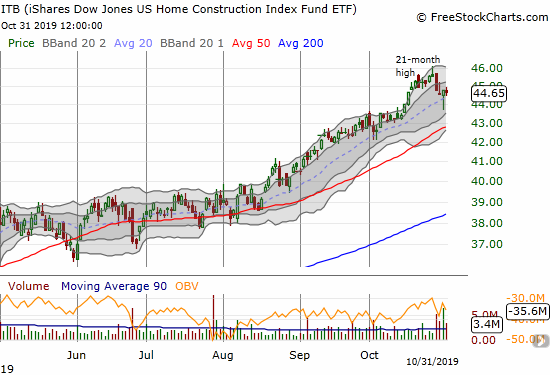

This is a moment of truth for the stocks of homebuilders. The iShares Dow Jones Home Construction ETF (ITB) last week hit a 21-month high that exactly coincided with a climactic high in January, 2018. The subsequent selling this week seemed to unfold like clockwork. The selling was particularly notable given the S&P 500 (SPY) … Read more