(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2013. Click here to read the entire piece.)

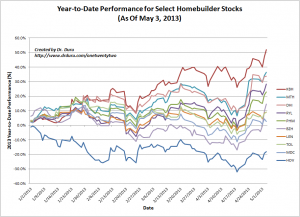

In late November, 2012, I made a list of my homebuilder picks for 2013. I combined valuation, price changes, and short interest to build the list. Almost 6 months later, it is time to review how this list is performing.

{snip}

Last year turned out to be a banner year as the market well-anticipated a bottom in the housing market. I designated that year as one to buy homebuilders on the dips in anticipation of a bottom in 2013, but I was not bullish enough. {snip}

Click graph for enlarged image…

Source: Prices from Yahoo!Finance

My favorite pick for this year, MTH, is currently in second place for year-to-date performance. I covered the last earnings call in “Meritage Homes Remains A Top Pick As It Fires On All Cylinders .” However, my second pick, MDC, has traded down for the year at times and is just barely even after reporting earnings last week. {snip}

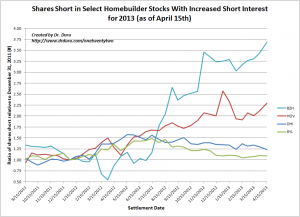

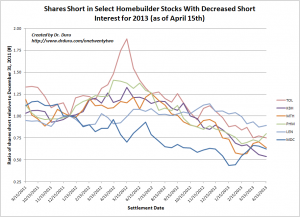

Short interest has largely continued its momentum from last year. {snip}

Source: NASDAQ Short Interest

Last year, I assumed that a sharp decline in short interest would correspond to relatively strong price performance and a presumption of bullish earnings performance. {snip}

TPH gets a special mention with regards to short interest. The company went public in January of this year, so I cannot include it in the above charts. Bears have gone right to work on the stock. {snip}

For those interested, I have placed the tables relating short interest to prices and fundamental ratios in a Google spreadsheet.

Overall, 2013 should continue to be a year to be picky. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2013. Click here to read the entire piece.)

Full disclosure: no positions