All-Time Highs Leave Bear Cycle Behind With Breadth In Catch-Up Mode

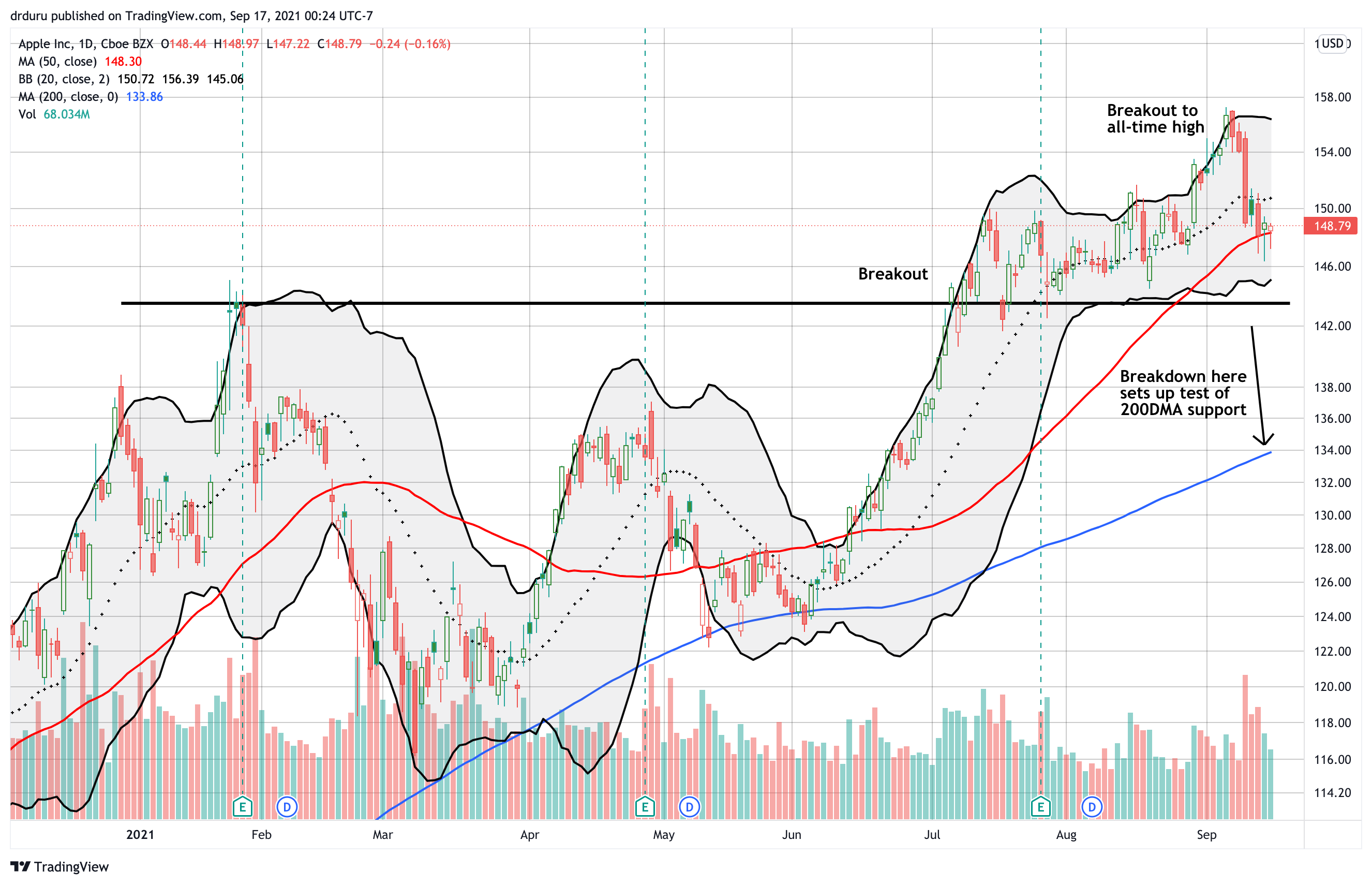

Stock Market Commentary A week ago I pointed out the key signs suggesting the bear cycle was likely already ending. Last week, the S&P 500 (SPY) confirmed the end of the bear cycle with fresh all-time highs. Yet, consistent with this year’s theme, market breadth was left behind in catch-up mode. The momentum on both … Read more