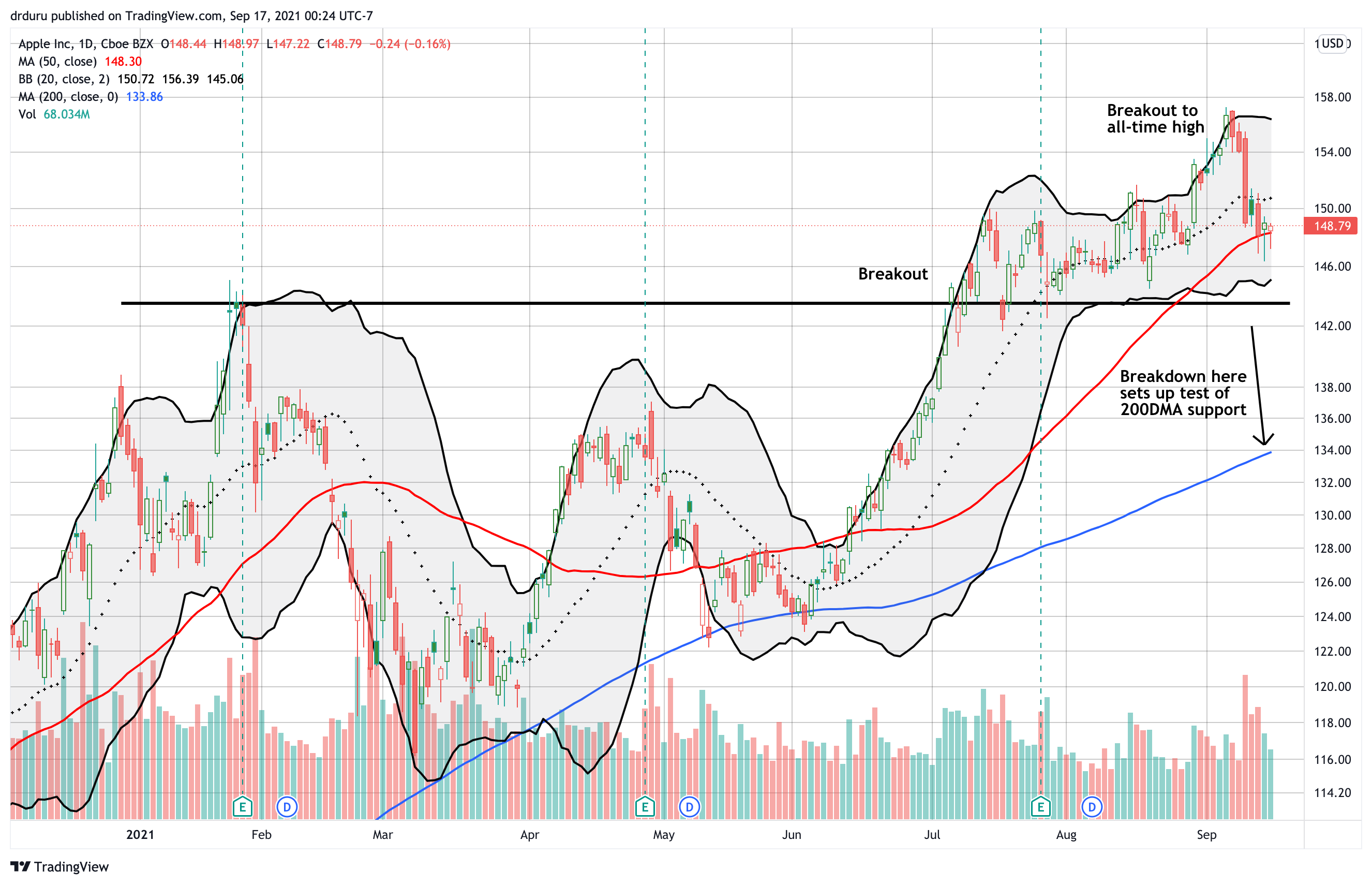

Apple: A Stock Perched On A Line Dividing Rally From Churn

Apple Dividing Rally from Churn The latest cycle of the Apple Trading Model (ATM) happened between a legal setback for Apple and a product launch event. The week began somewhat hopeful with a small gain. Sellers ended the prospects for the Apple trade by fading the product announcement with a 1.0% loss and a close … Read more