Stock Market Rebounded from the Brink of A Real Sell-Off – Above the 40 (May 14, 2021)

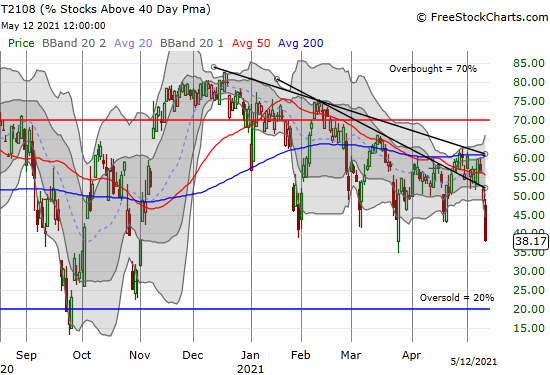

Stock Market Commentary Last week featured yet another episode of momentary panic proceeded by a virtual “all clear” signal. In the middle of the week, the S&P 500 (SPY) broke down just as the stock market hit extremes. Subsequently, buyers stepped into the breach. As a result, the very next day, the stock market rebounded … Read more