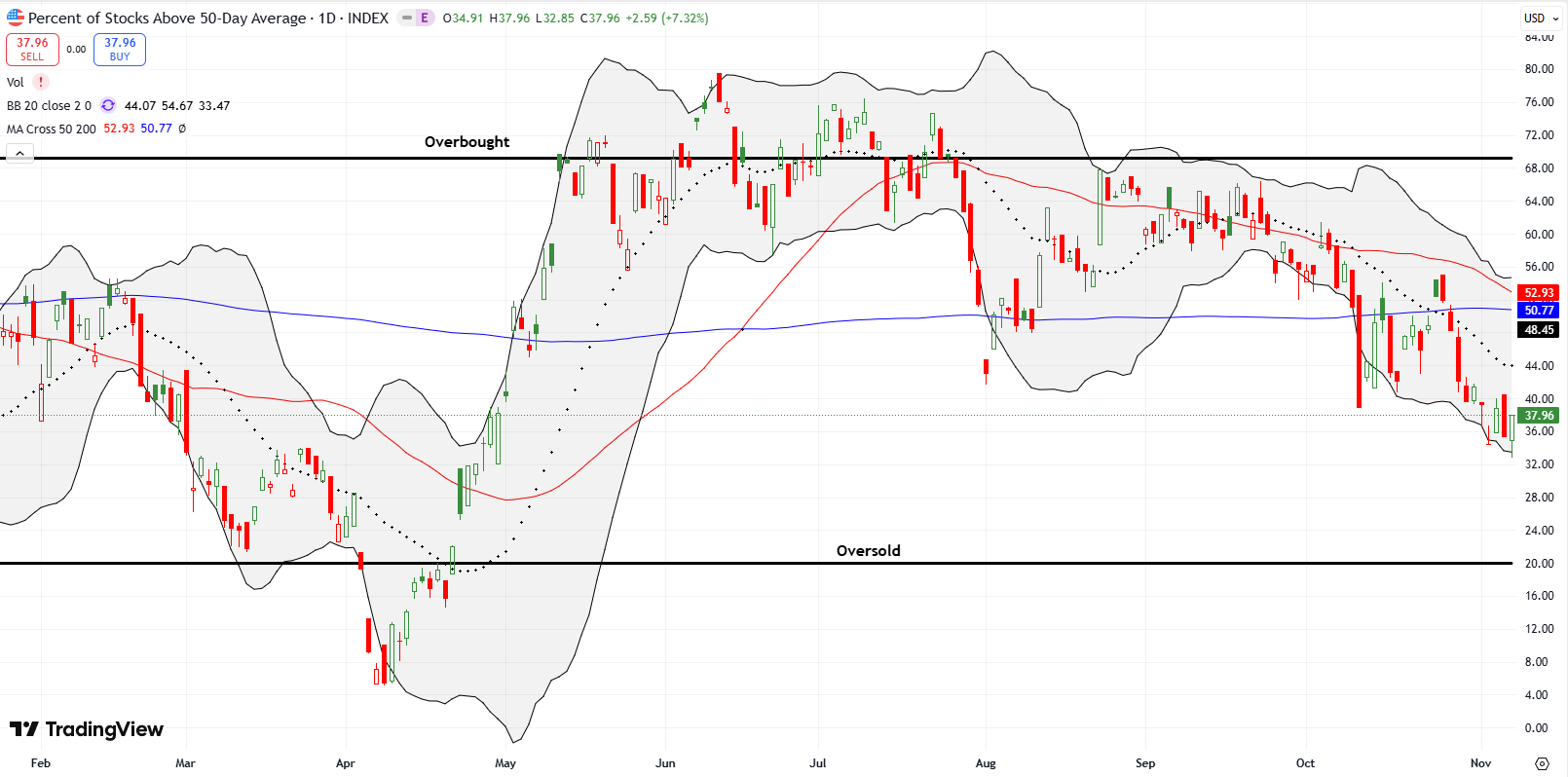

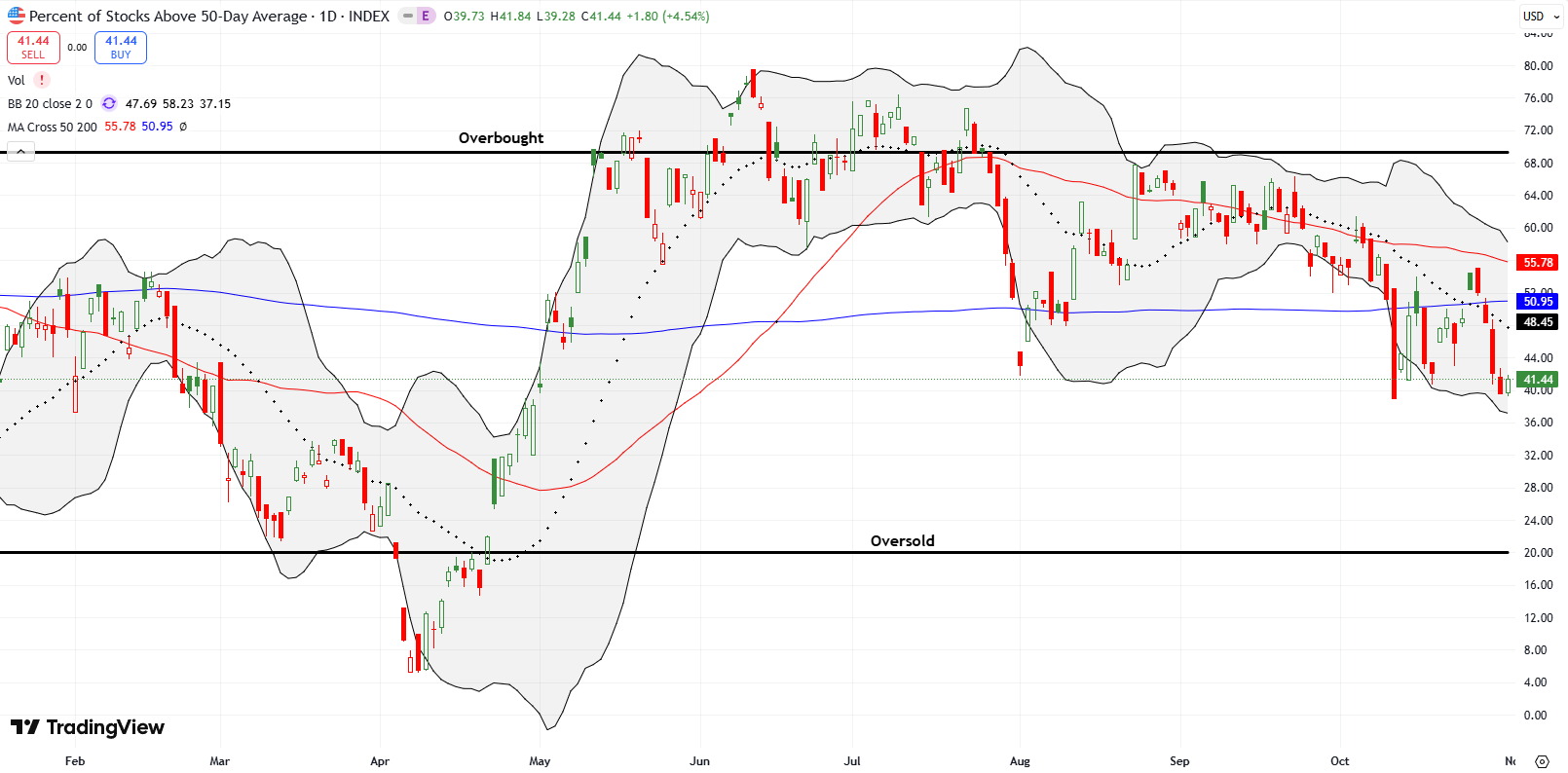

A Tired AI Trade Weighs on Market Breadth Breakout – The Market Breadth

Stock Market Analysis Summary The market initially welcomed the Fed’s rate cut, but rising long-term yields recreated the same headwinds seen after the October rate cut. A tired AI trade emerged as Oracle, Broadcom, NVIDIA, and semiconductors sold off sharply, pressuring market breadth. Major indices showed signs of topping despite prior strength, especially the NASDAQ … Read more