Pressure Intensifies for Software Stocks – The Market Breadth

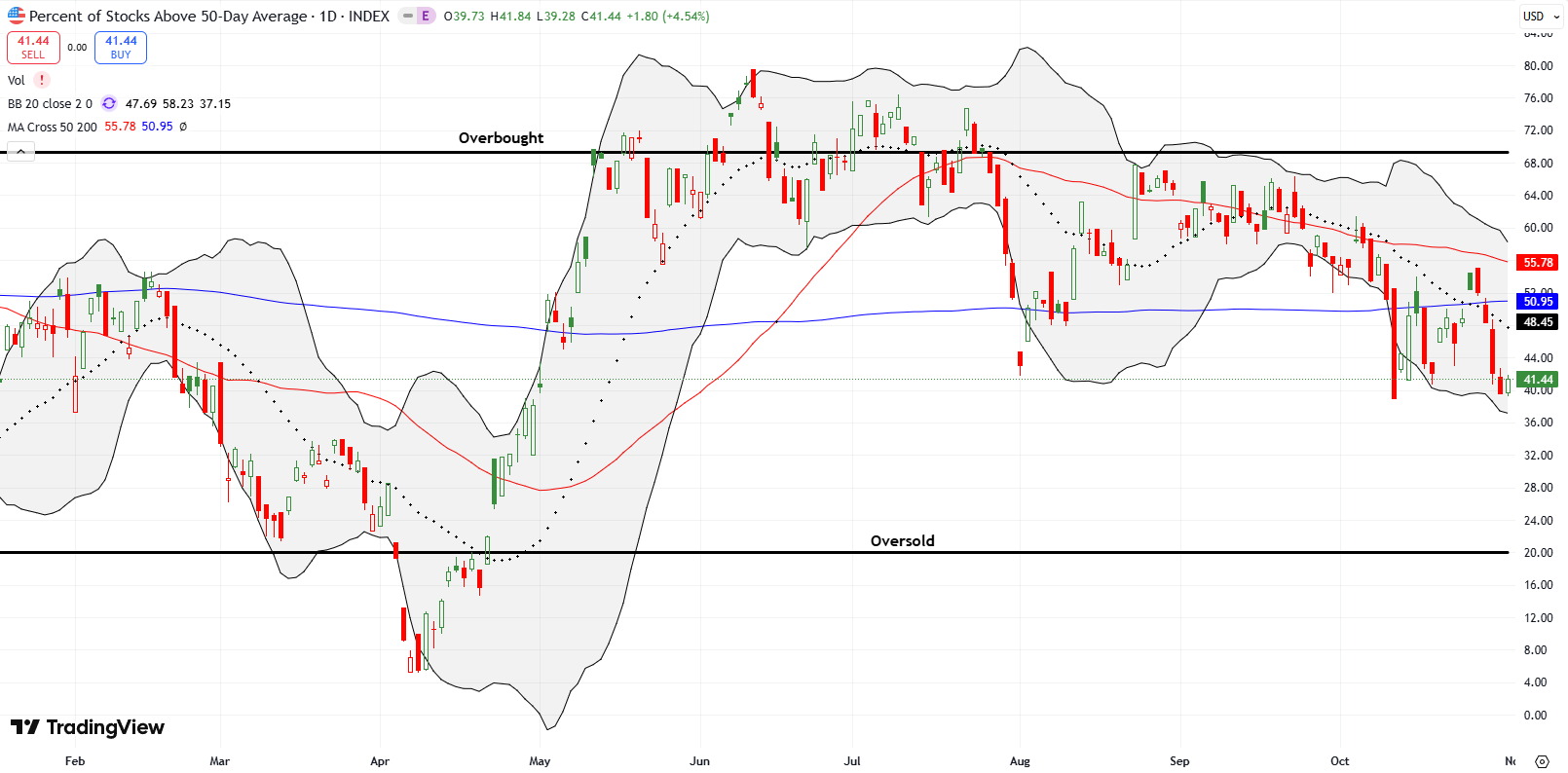

Stock Market Analysis Summary Mounting pressure on software stocks stands out as weakening market breadth coincides with multiple key technical breakdowns. A neutral stance remains appropriate as market breadth continues to deteriorate, offsetting selective AI-driven strength in semiconductors and small caps. Buying decisions stay highly selective, with technical confirmation guiding risk while bearish signals continue … Read more