Breakdowns + Pullbacks = Risk Off Again – The Market Breadth

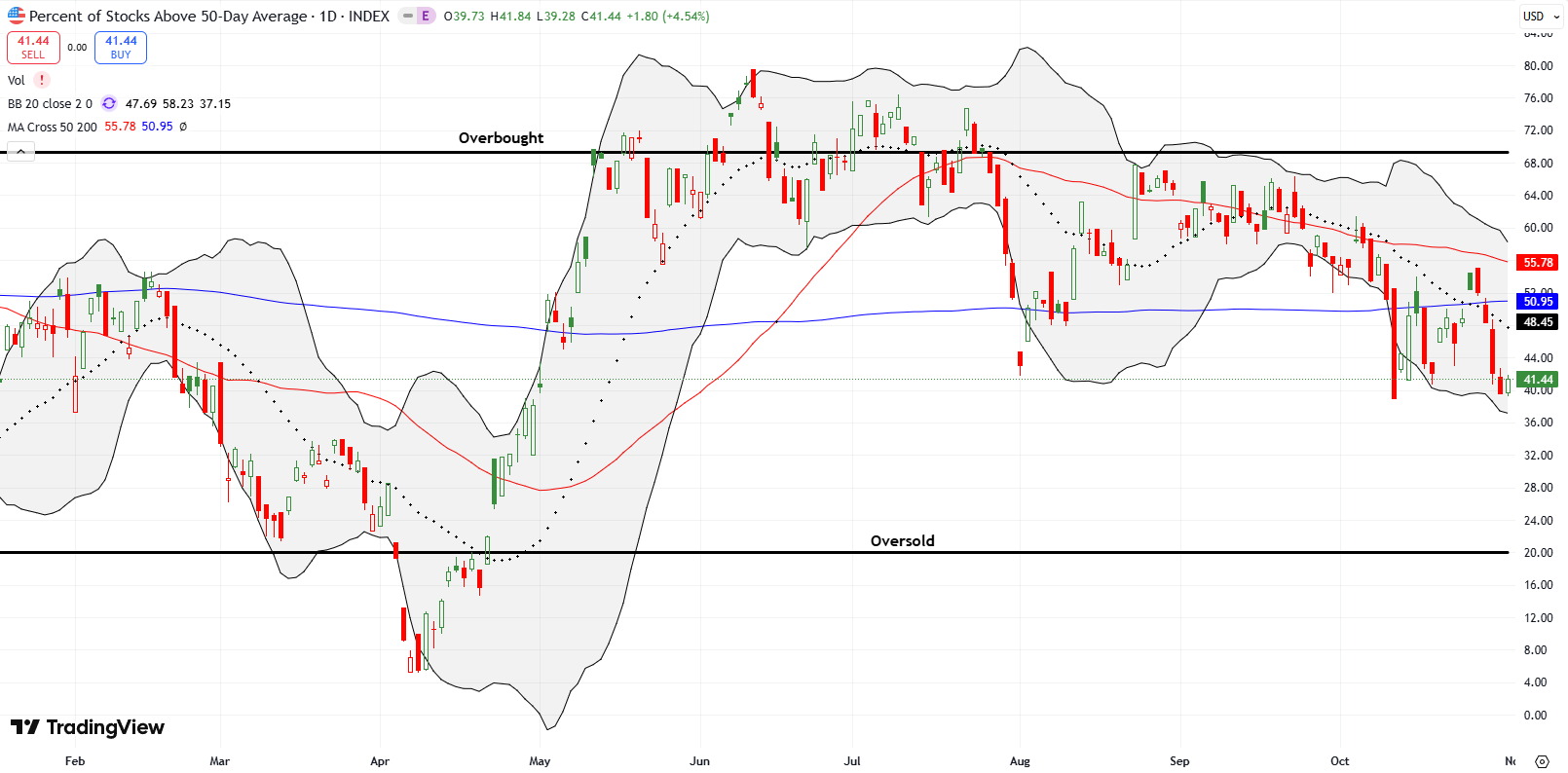

The Market Breadth Summary Stock Market Commentary The first month of the new year ended in an eventful fashion with significant news both good and bad, sometimes abrupt. The bad news convinced me to go risk off again as breakdowns and pullbacks weighed heavily on individual stocks. The major indices hid the extent of the … Read more