Holiday Spirits Heal A Cracked Stock Market – The Market Breadth

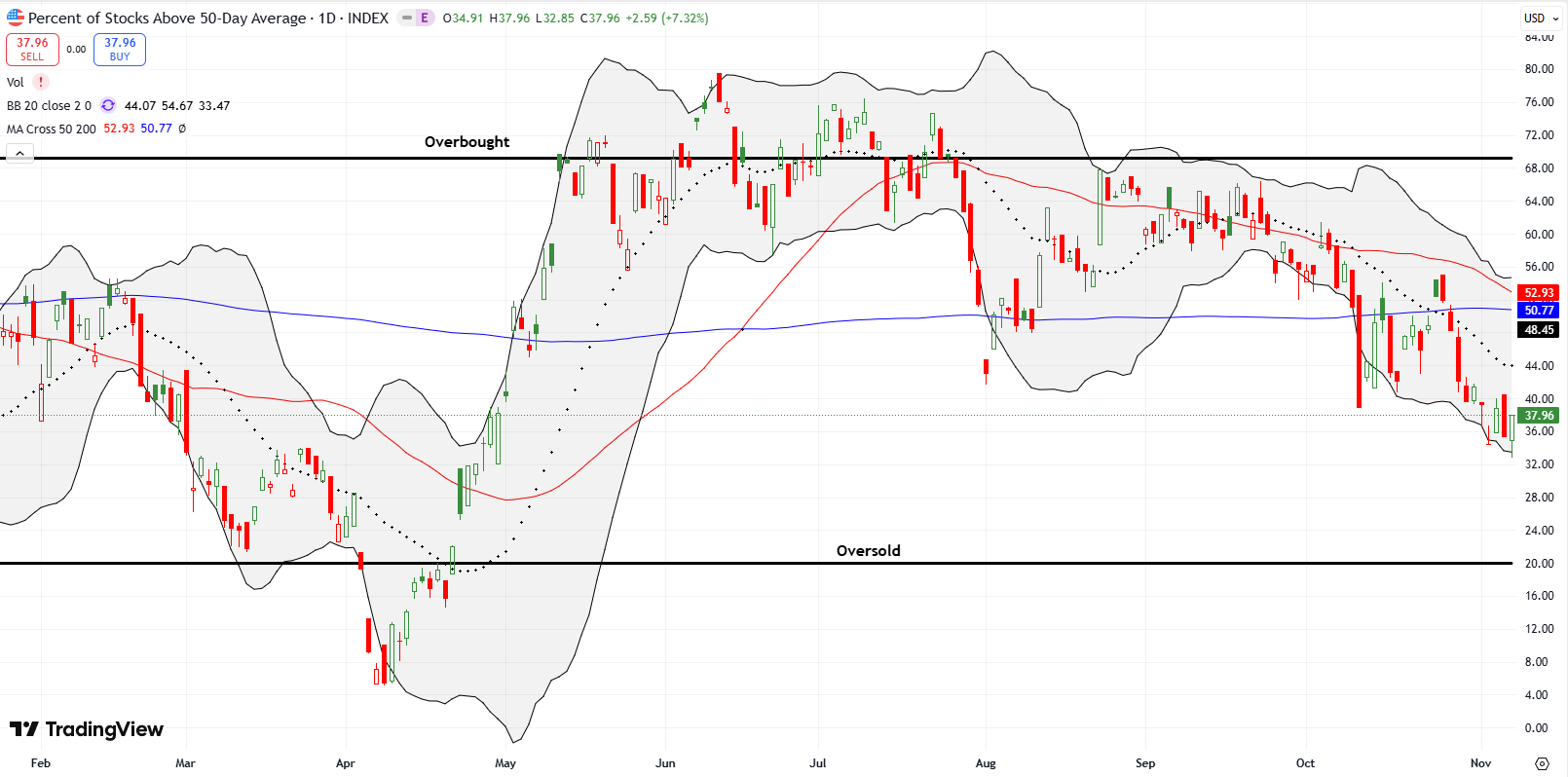

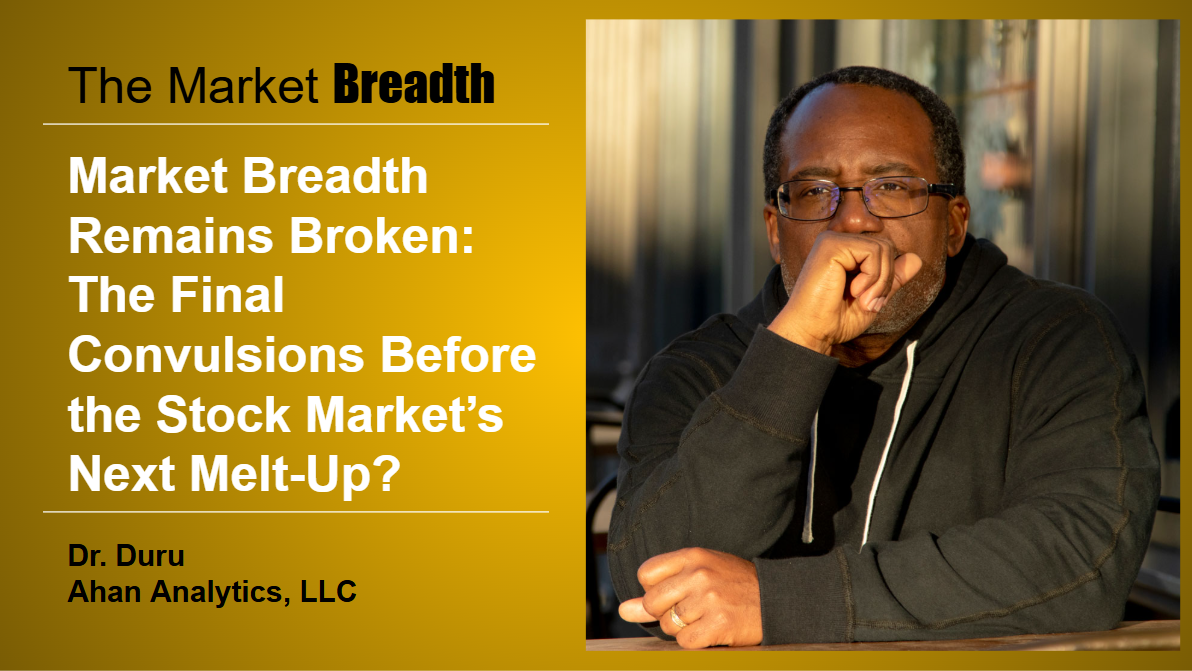

Stock Market Analysis Summary Stock market indices, including the S&P 500, NASDAQ, and Russell 2000, staged sharp recoveries, breaking key resistance levels as holiday spirits fueled by revived rate cut hopes apparently helped to heal a cracked stock market. Market breadth expanded sharply, with the percentage of stocks trading above their 50-day moving averages (AT50) … Read more