The Magic of All-Time Highs – The Market Breadth

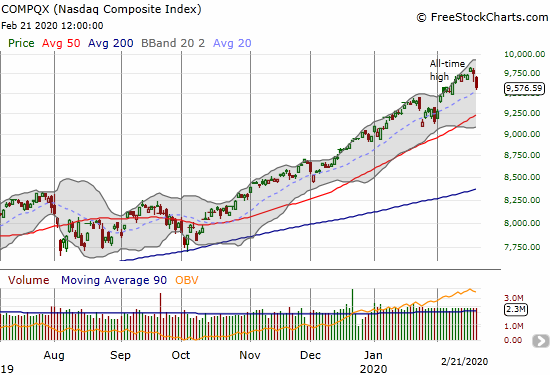

Stock Market Commentary Last week delivered the magic of all-time highs. Another all-time high for the S&P 500 and the NASDAQ’s entry into the all-time high club provided a benign feel to the stock market. Financial markets even look like a safe haven from all the turmoil and trouble in the world. Investors and traders … Read more