A Remarkable Year Ends With Signature Stock Market Moments – The Market Breadth

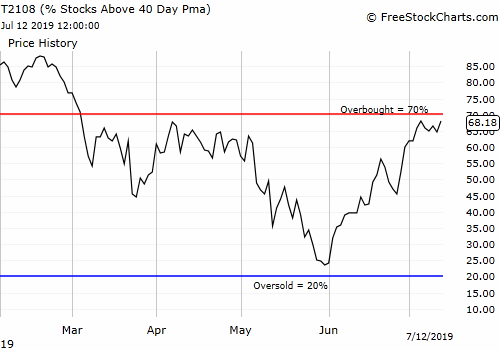

Stock Market Commentary Signature stock market moments capped a remarkable year for the stock market. Two months of nearly relentless buying delivered a stunning 70% of the gains for the S&P 500 in 2023 after bulls exploded out of oversold trading conditions. Housing-related stocks soared even more as financial markets celebrate the presumed end of … Read more