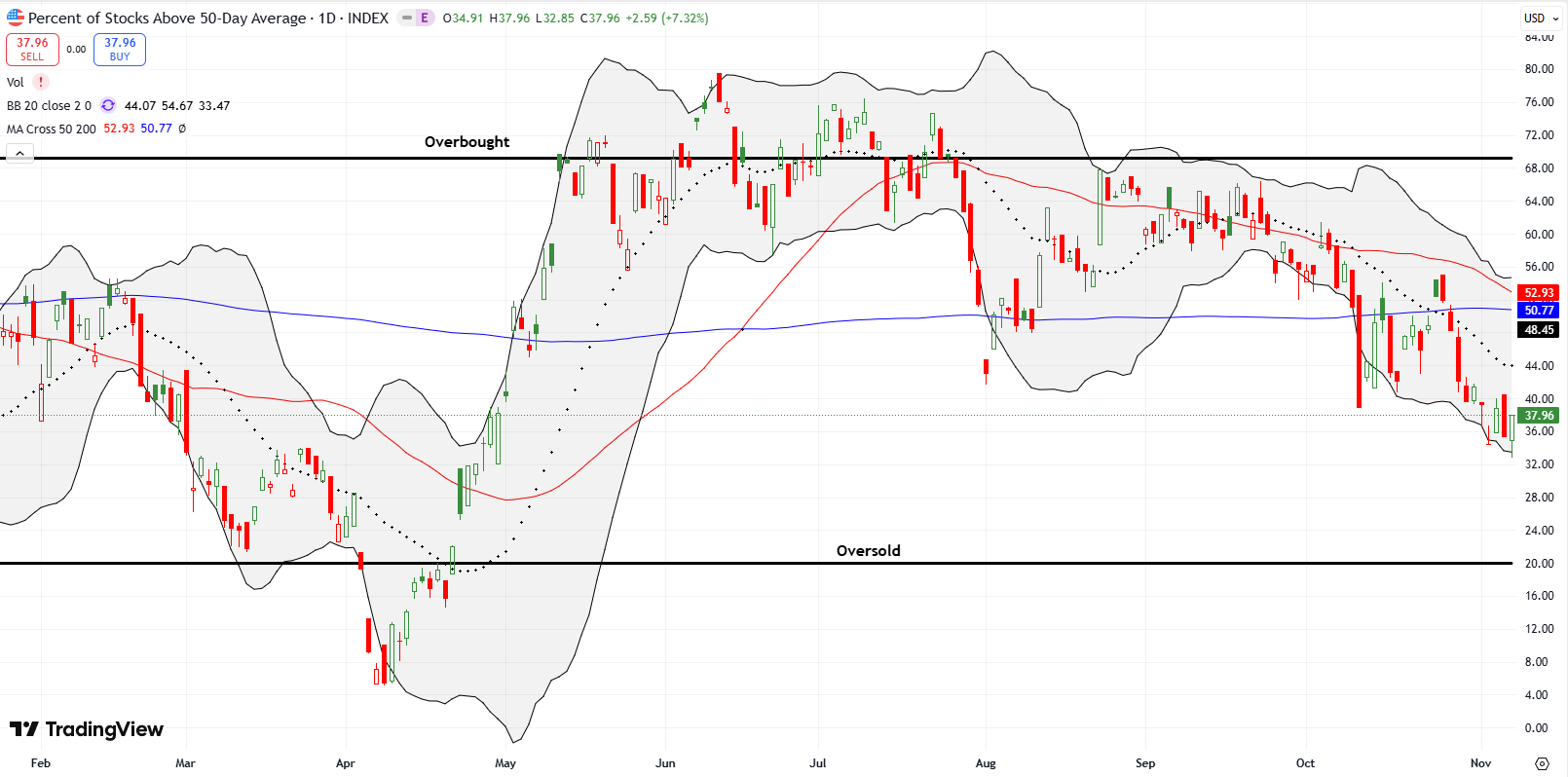

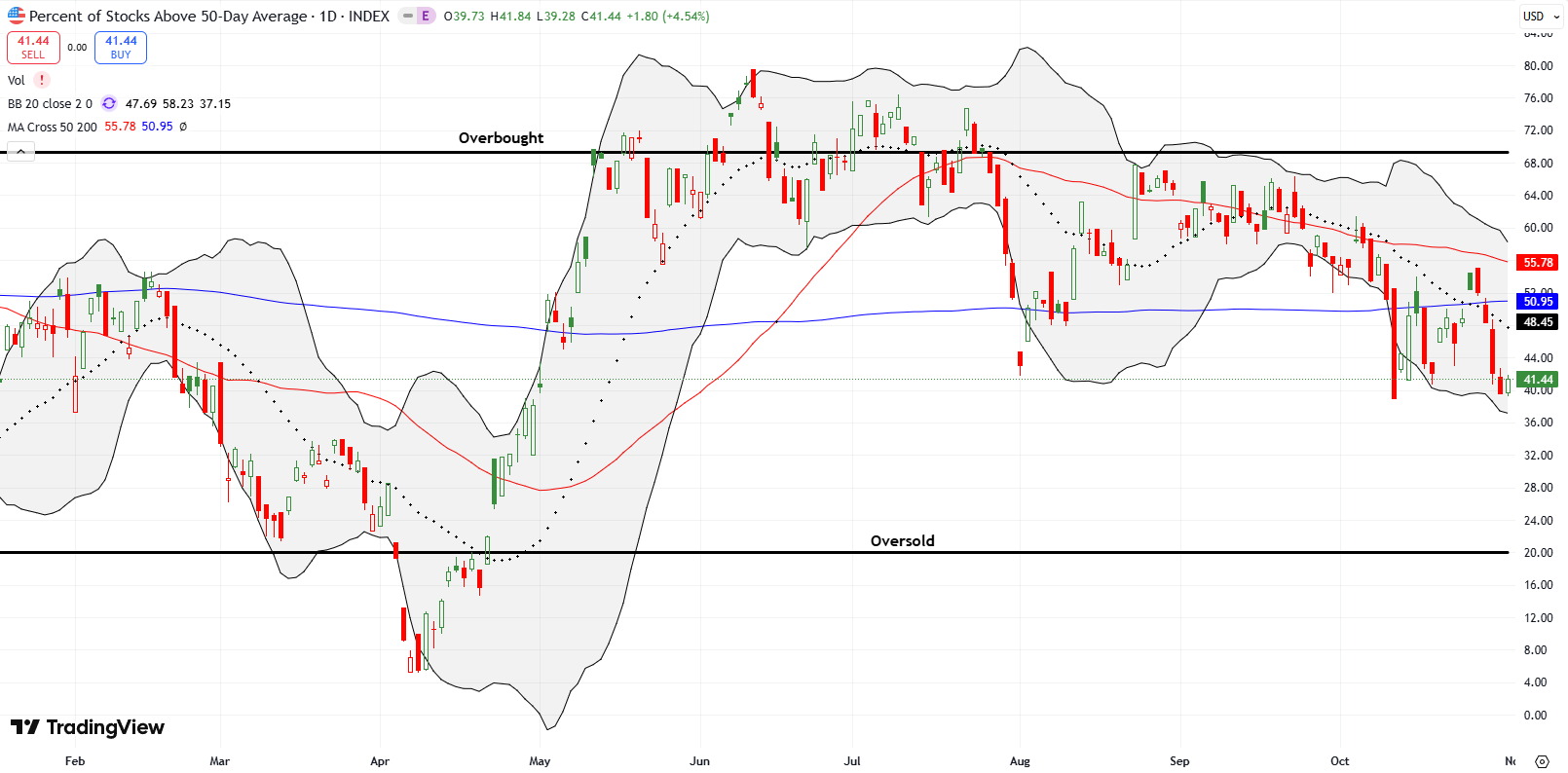

Cracks Wide Open in the Stock Market – The Market Breadth

Stock Market Analysis Summary Market liquidity fears intensified across equities and crypto as market breadth continued to deteriorate. The major stock market indices confirmed bearish technical breakdowns. Major AI and tech stocks confirmed weakening momentum. The week ended with a relief rally after rate-cut expectations surged with Fed Governor Williams teasing a possible December easing. … Read more