A Confident Calm in the Stock Market – The Market Breadth

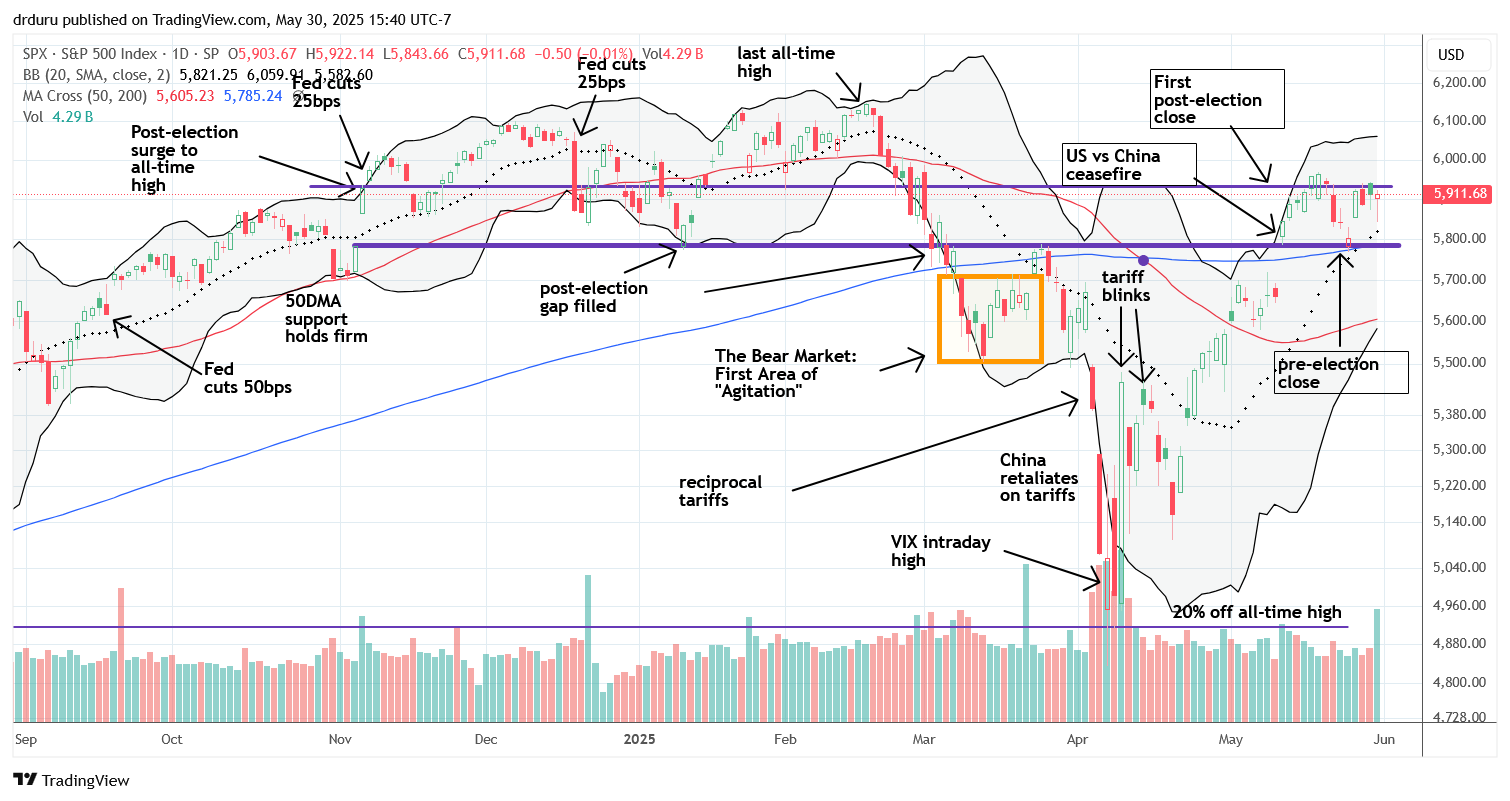

Stock Market Commentary The stock market transitioned from a nervous calm to a confident calm. The NASDAQ and S&P 500 hit fresh all-time highs faster than I could have expected during the depths of the tariff drama, trauma, and noise. Nvidia (NVDA) led the way with a mid-week breakout to all-time highs. The market’s confident calm … Read more