The Stock Market Pushes Through Its 50DMA Resistance – Above the 40 (September 28, 2020)

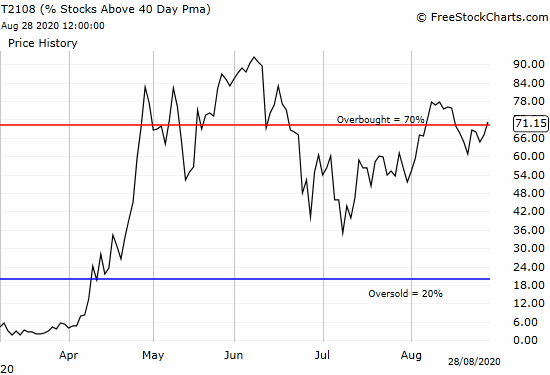

Stock Market Statistics AT40 = 33.6% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 42.6% of stocks are trading above their respective 200DMAs VIX = 26.2 Short-term Trading Call: cautiously bullish Stock Market Commentary The major indices bounced out of oversold trading conditions only to face down the immediate challenge … Read more