Bitcoin Price Failure

In late May, a “price failure” in Bitcoin (BTC/USD) sent me to the sidelines. I decided to retreat to wait for a breakout and accumulate a new position on the way up. Two months later the moment arrived. The U.S. dollar (DXY) broke down and Bitcoin broke out. As a result, I jumped back into cryptocurrency speculation. I bought higher prices under the assumption that Bitcoin was finally leaving the $10K level behind.

The gains from the $10K breakout looked precarious after a $12K breakout on August 17th was immediately reversed the next day. Bitcoin weakened consistently from there. This weekend, the magnet at $10K crushed the breakout: BTC/USD plunged to and briefly through $10K.

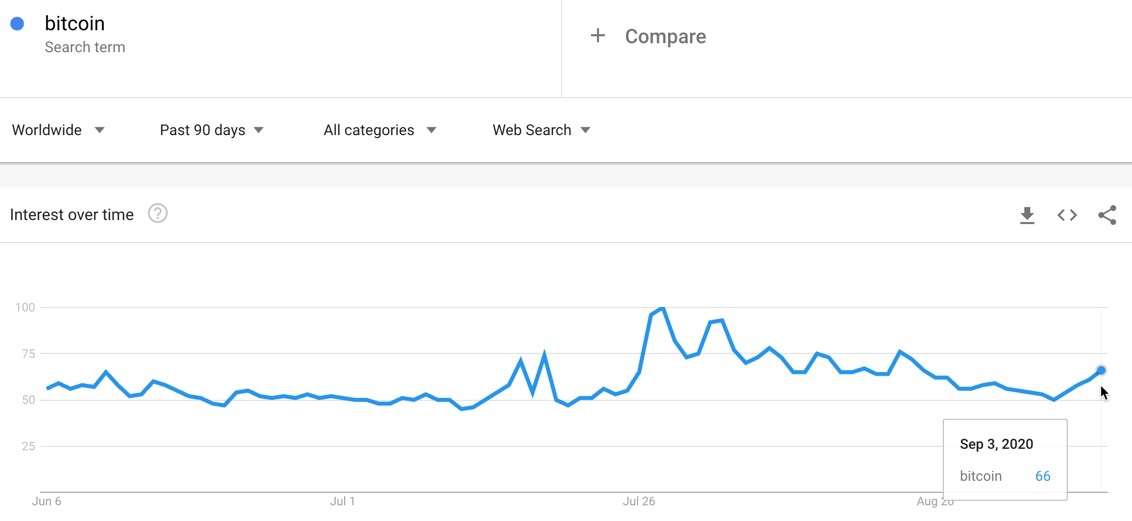

At the time of writing BTC/USD clings to $10K support. The Google Trend Momentum Check (GTMC) suggests more weakness lies ahead. An extension of this price failure transforms into a BTC/USD breakdown. The sudden selling in Bitcoin did not generate a parallel surge in search interest. When extreme price action generates an extreme in search interest, price action tends to reverse. For example, the selling should generate interest and convince speculators to buy “low” prices.

Bitcoin Still Not Ready for Prime Time

This latest price failure for Bitcoin once again demonstrates that investors should not use the cryptocurrency as a hedge against troubles in financial markets. Bitcoin’s tumble coincides with a sharp pullback in the stock market. When the S&P 500 (SPY) suddenly suffered a 5.9% one-day loss on June 11th, Bitcoin fell as well. The liquidity crunch in the March pandemic stock crash, crushed Bitcoin as well.

I am also watching the close correlation of Bitcoin to other major cryptocurrencies during big price moves. For example, on July 21st, both Ethereum (ETH/USD) and BTC/USD started rallying out of periods of extended consolidation. ETH/USD exhibited a clear breakout the next day. BTC/USD conquered its $10K level another 5 days later. Both ETH/USD and BTC/USD started tumbling on September 2nd along with the stock market. Note that I like the more powerful breakout that Ethereum experienced.

The Bitcoin Price Failure Trade

I continue to hold my Bitcoin breakout position. I am bracing for lower prices, so I have returned to a buy-the-dip mentality. A complete reversal of the Bitcoin breakout back to $9200 is in play. However, I am not interested in adding to my position until/unless Bitcoin tumbles to $8000 or lower. I need a significant discount to justify the risks of holding more Bitcoin. Note that I stay involved in Bitcoin because I believe one day the cryptocurrency converts will figure this thing out; Bitcoin in particular will be more than a speculative asset only good for trading. As a result, I want to pay attention.

Be careful out there!

Full disclosure: long BTC/USD