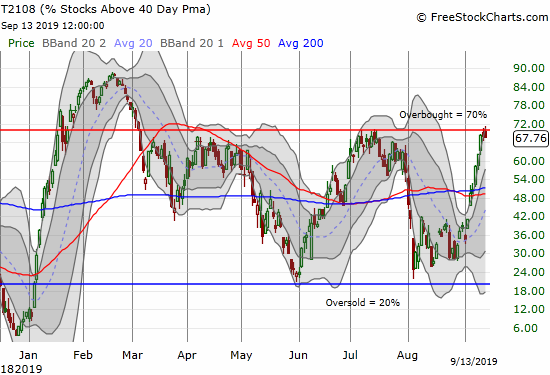

Stock Market Stalls At Overbought Threshold As Momentum Stocks Retreat – Above the 40 (September 13, 2019)

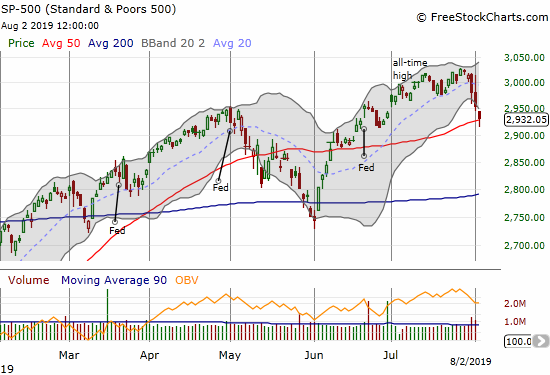

AT40 = 67.8% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 58.8% of stocks are trading above their respective 200DMAs (13-month high)VIX = 13.7Short-term Trading Call: neutral Stock Market Commentary Overbought Overrules Times like these remind me of the significance of the overbought line. AT40 (T2108), the percentage of stocks … Read more