Overbought Trading Resumes With Fresh Momentum for the Reopen Trade – Above the 40 (November 13, 2020)

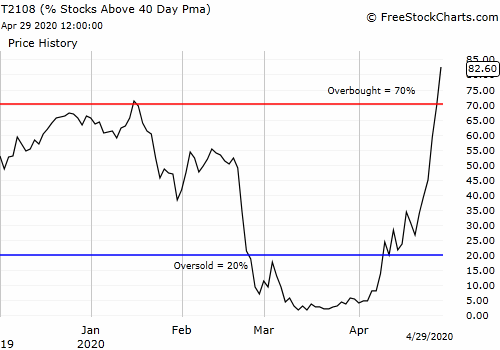

Stock Market Statistics AT40 = 74.4% of stocks are trading above their respective 40-day moving averages (DMAs) (Day #1 overbought, 3 of last 4 days ooverbought) AT200 = 68.1%% of stocks are trading above their respective 200DMAs (near 3-year high and holding breakout above post financial crisis downtrend) VIX = 23.1 Short-term Trading Call: neutral … Read more