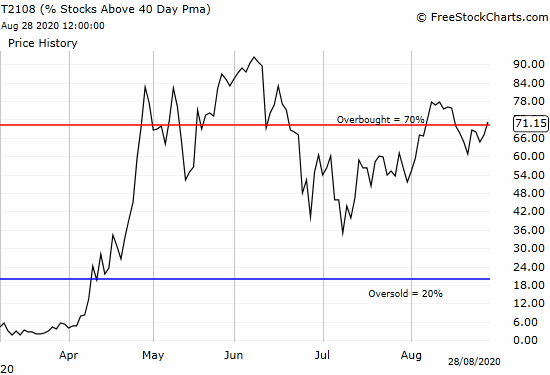

An Overbought Stock Market Celebrates New Fed Inflation Policy – Above the 40 (August 28, 2020)

Stock Market Statistics AT40 = 71.2% of stocks are trading above their respective 40-day moving averages (DMAs) (ended 7 overbought trading days)AT200 = 46.5% of stocks are trading above their respective 200DMAs VIX = 23.0Short-term Trading Call: cautiously bearish Stock Market Commentary Last week was not a good time to be sitting on the sidelines … Read more