An Overbought Stock Market Faces Down the Stimulus Stalemate – Above the 40 (August 14, 2020)

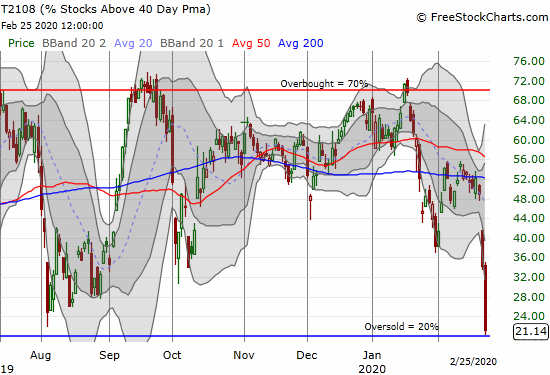

Stock Market Statistics AT40 = 76.1% of stocks are trading above their respective 40-day moving averages (DMAs) (6th day overbought)AT200 = 46.3% of stocks are trading above their respective 200DMAs VIX = 22.1Short-term Trading Call: cautiously bullish Stock Market Commentary While the politicians in Washington D.C. play a game of chicken with the economy, the … Read more