An Oversold Stock Market Is A Market Caring About Risk – Above the 40 (February 26, 2020)

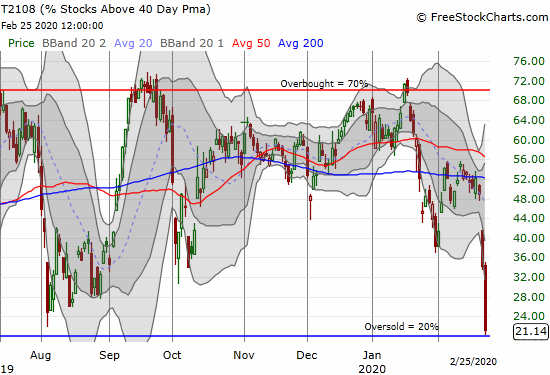

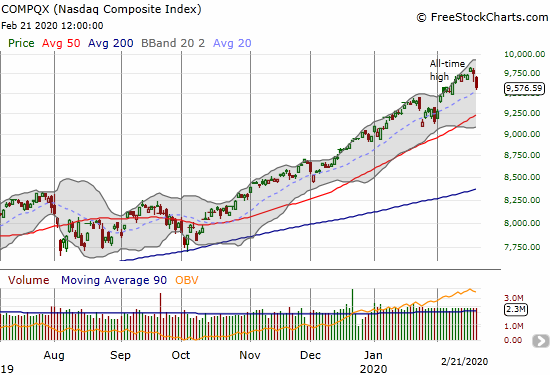

AT40 = 18.5% of stocks are trading above their respective 40-day moving averages (DMAs) (oversold day #1)AT200 = 36.6% of stocks are trading above their respective 200DMAs (near 13-month low)VIX = 27.6Short-term Trading Call: cautiously bullish Stock Market Commentary Oversold The action in the stock market continues to move fast. On Tuesday, I declared the … Read more