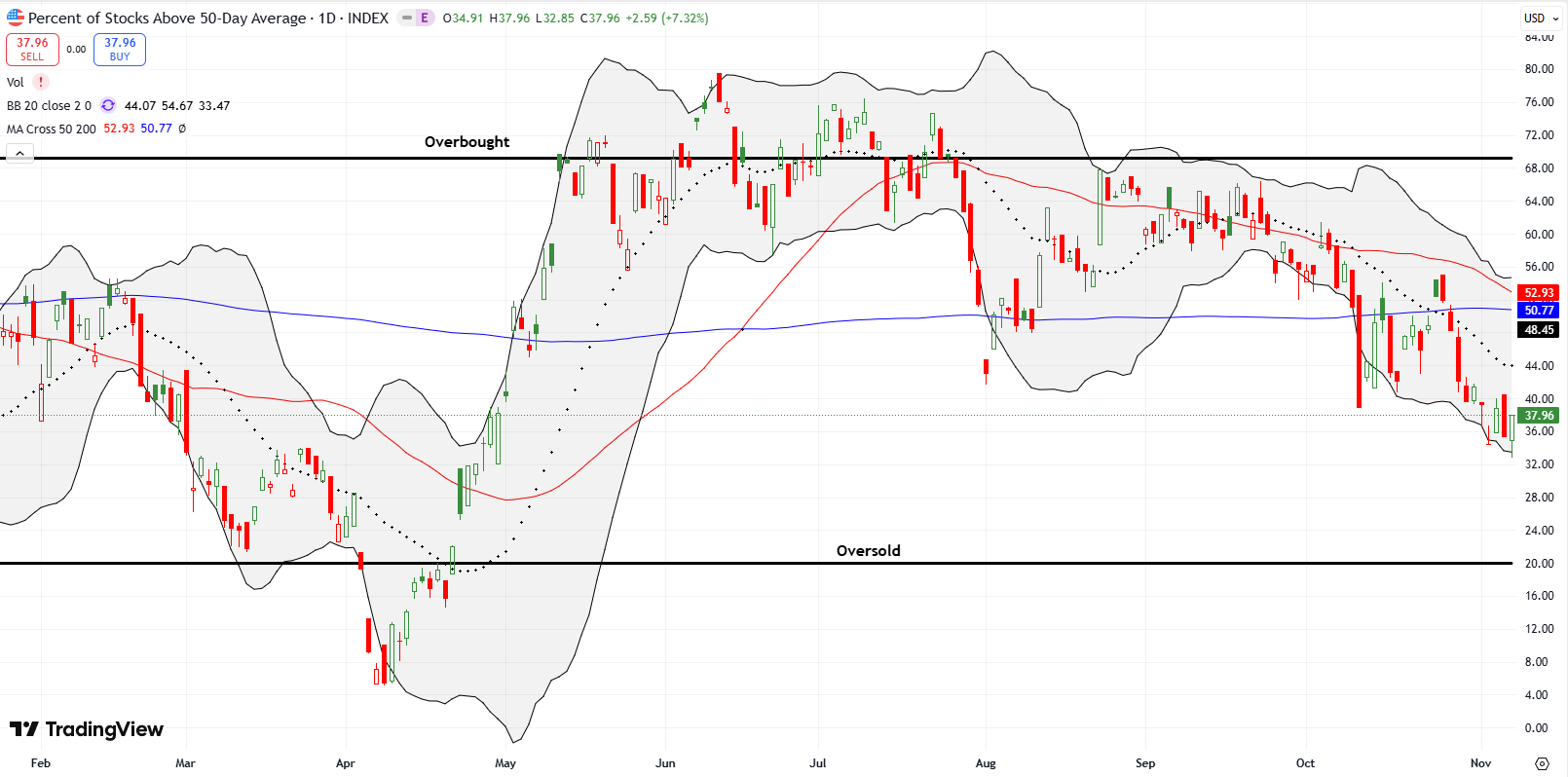

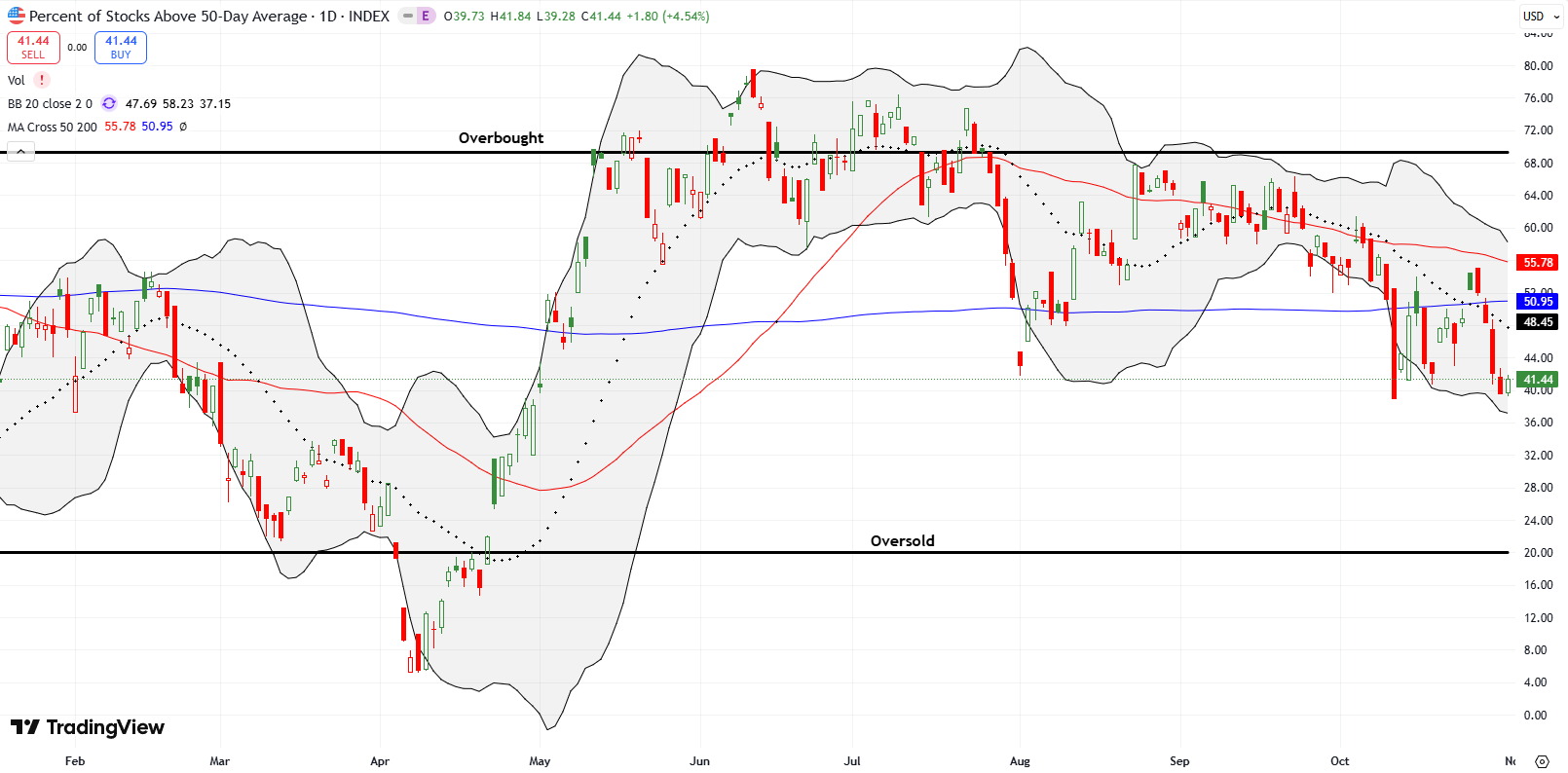

Cracks Widening in the Stock Market – The Market Breadth

Stock Market Commentary I am seeing more and more cracks widening in the stock market, and I am getting increasingly concerned. I am trying to stay bullish because the seasonally strong period has started for the stock market. However, after such a strong August, strong September, and strong October, each of which is historically one … Read more