Key Stock Sectors Missed A Breakout In Market Breadth – Above the 40 (June 11, 2021)

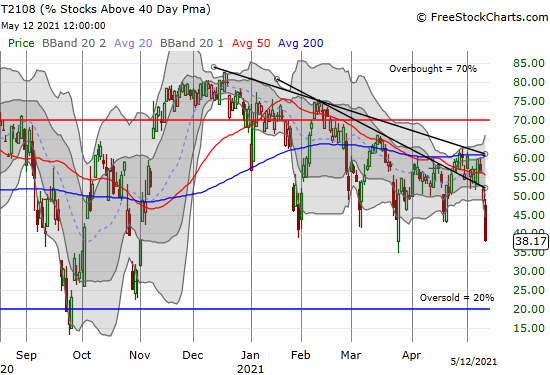

Stock Market Commentary The stock market struggled for months against the downtrend line on market breadth. The struggle ended last week. My favorite technical indicator of breadth AT40 (T2108) broke out and closed the week at 61.9%. Now I start a countdown toward a test of the overbought threshold. However, several sectors dampened the week’s … Read more