Overbought Trading Conditions, Yet Still Bullish – The Market Breadth

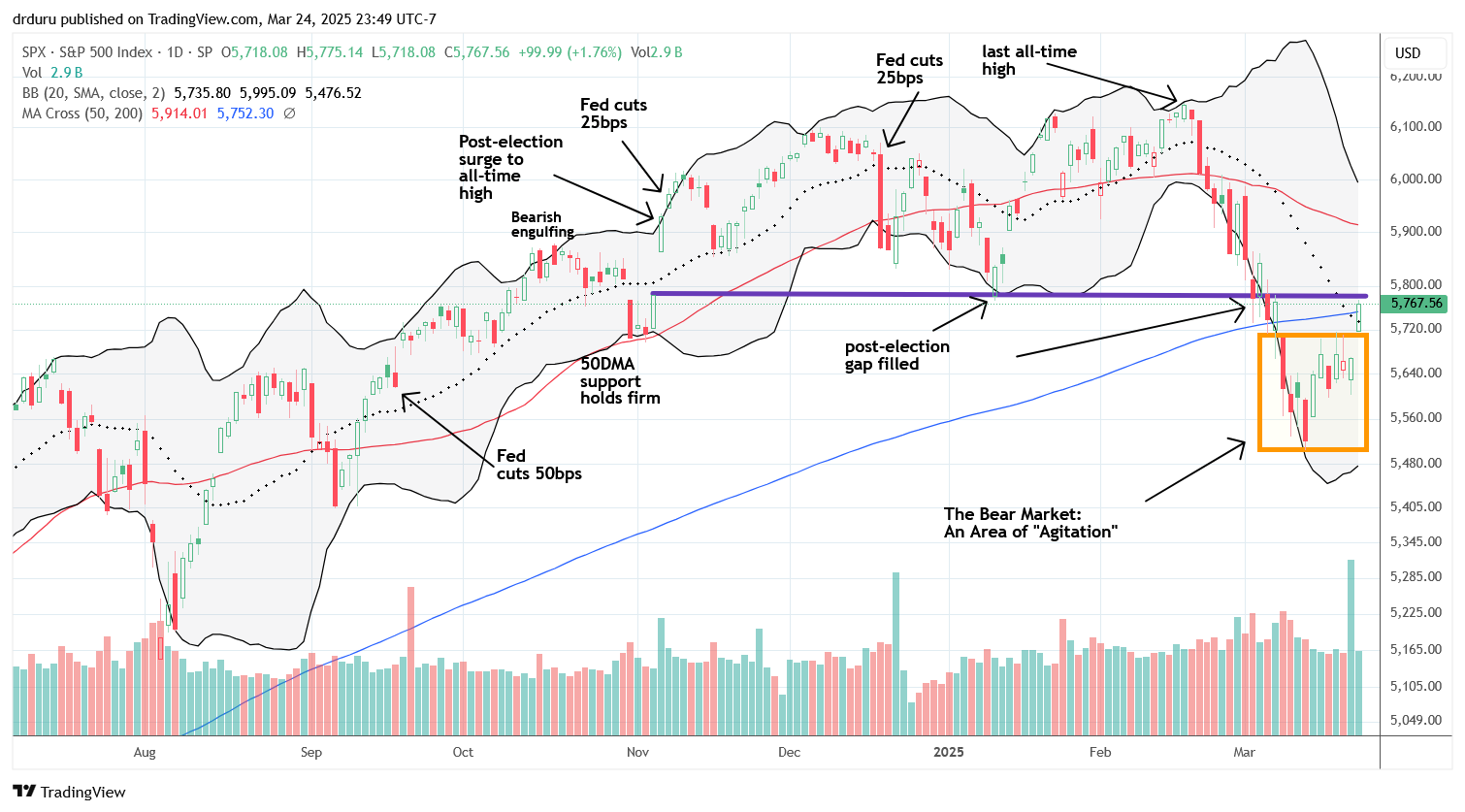

Stock Market Commentary We made it through another week without any major negative headlines impacting the stock market. Although late-breaking news took futures down due to Moody’s dropping the U.S. from its top credit rating, marking the loss of the last top-tier assessment of U.S. government debt, I expect the market impact to be minimal. … Read more