A Two-Speed Stock Market Remains on Edge – Above the 40 (July 2, 2020)

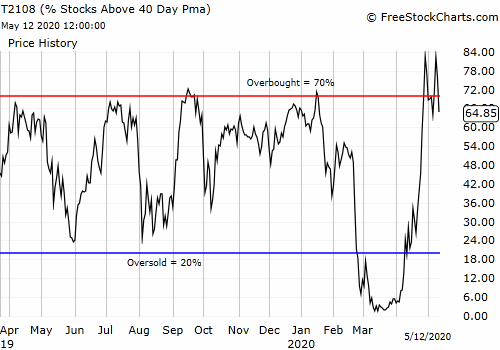

Stock Market Statistics AT40 = 53.9% of stocks are trading above their respective 40-day moving averages (DMAs) (2-month low)AT200 = 25.6% of stocks are trading above their respective 200DMAs VIX = 34.7Short-term Trading Call: neutral Stock Market Commentary The damage in the stock market the previous week looked strong enough to eventually take trading conditions … Read more