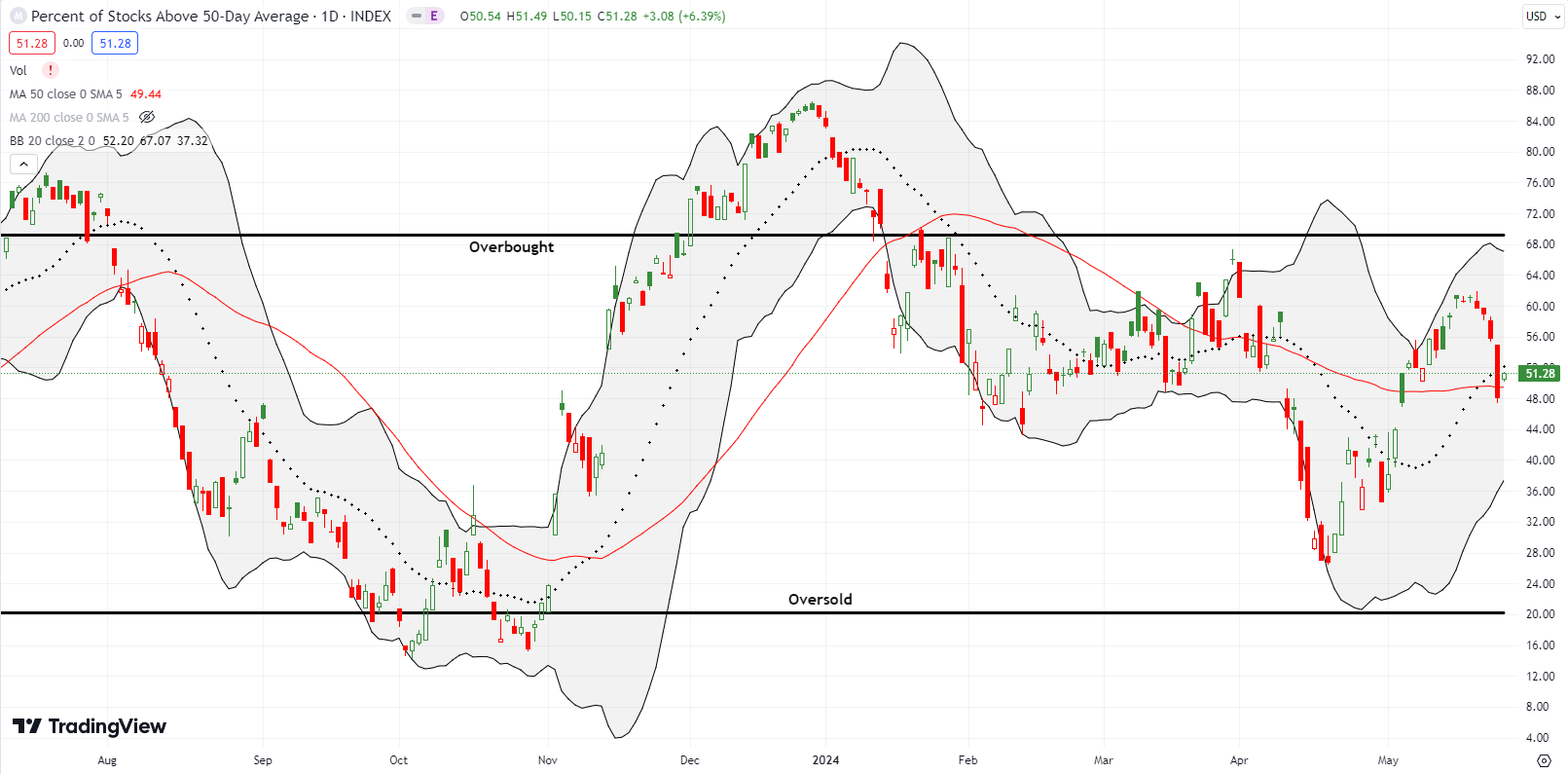

Market Breadth Fades After Small Caps Lead Breadth Breakout

The Market Breadth Summary Small cap stocks led a market breadth breakout, then faded just short of overbought, leaving me encouraged by momentum but wary of a near-term pullback. The S&P 500 ground to fresh highs, while the NASDAQ lagged by stalling at prior peaks. A clean breakout still awaits for the NASDAQ. CES-driven leadership … Read more