Stock Bulls Add A Piece of the Puzzle, Challenges Remain

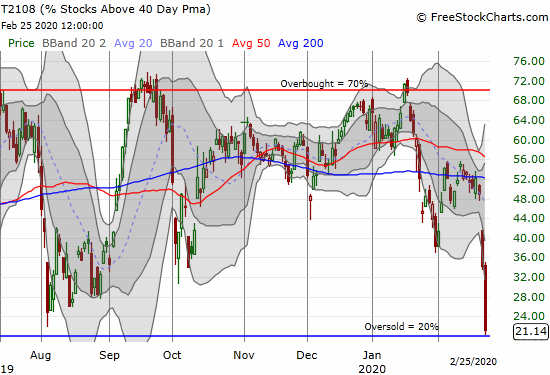

Stock Market Commentary In my last post, I concluded that the stock market rebound made the market look “stronger than before.” Today’s big rally went beyond the call of duty. The S&P 500 (SPY) and NASDAQ (COMPQX) showed off their increased strength by closing well above their respective upper Bollinger Bands (BBs). While its gain … Read more