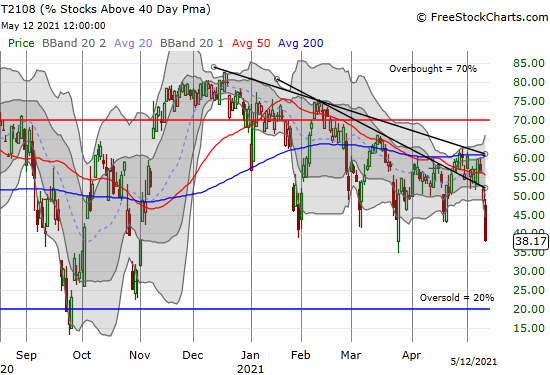

The S&P 500 Broke Down Just As the Stock Market Hit Extremes – Above the 40 (May 12, 2021)

Stock Market Commentary The S&P 500 (SPY) finally broke down and succumbed to the selling pressure building up in the stock market. A “surprise” surge in inflation as measured by the Consumer Price Index (CPI) delivered the headline catalyst for a day of broad-based selling. Given market breadth was already in the process of narrowing, … Read more