Market Breadth Breakout – Overbought Returns, Caution Fades – The Market Breadth

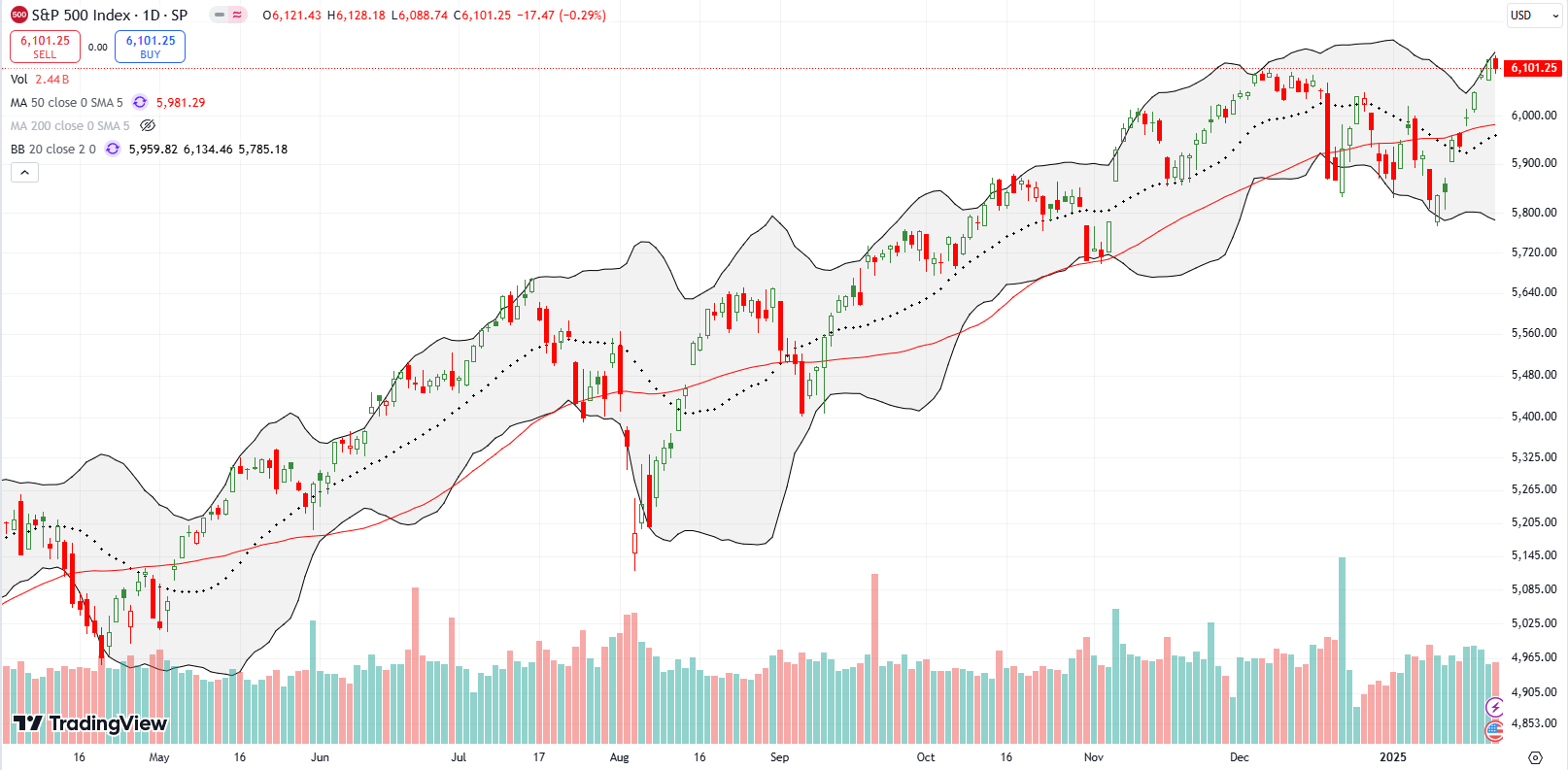

Stock Market Commentary After a holiday-shortened week, a market breadth breakout signals sentiment near peak bullishness. The market also seemed to interpret an unexpectedly strong jobs report as a positive, even as odds for rate cuts plunged (at the time of writing, 5% for later this month and 69.4% for September, down from 91% a … Read more