Market Relief Is Here. Not Clarity. – The Market Breadth

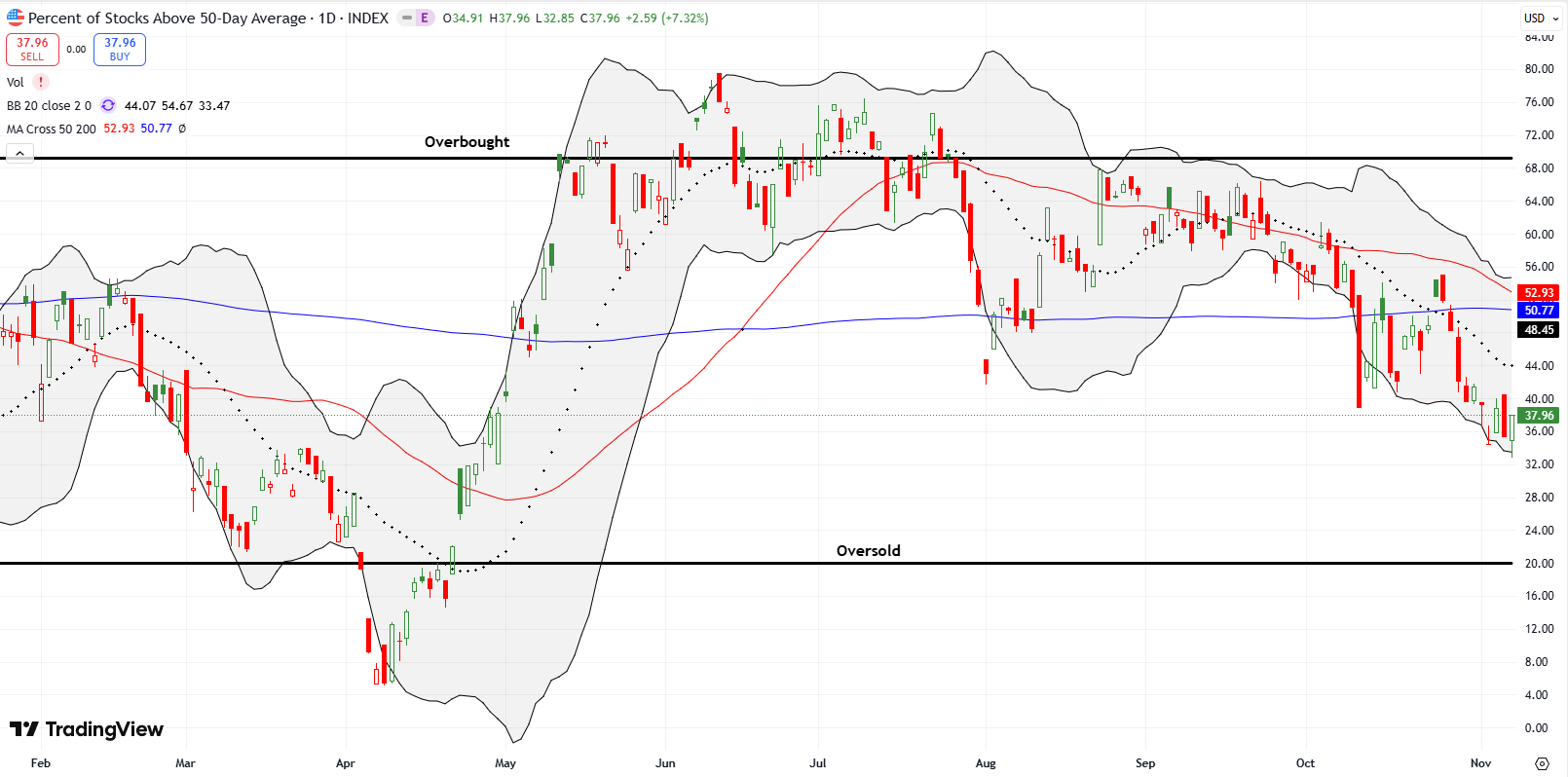

The Market Breadth Summary Stock Market Commentary I switched to “risk off” and cautiously bearish in late January. The subsequent bearish trading action unfolded mainly “under the hood” of the major indices from late January through the beginning of last week, before accelerated selling emerged. A major market rotation away from tech stocks started before … Read more