A Great Stock Market Divergence – Above the 40 (March 12, 2021)

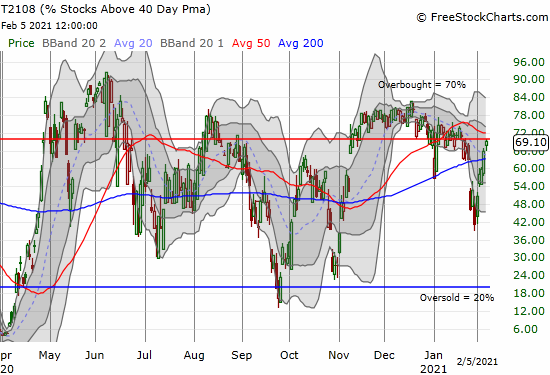

Stock Market Commentary A great stock market divergence clarified itself last week. Growth stocks, especially the expensive and/or speculative kind, took a back seat to industrial and consumer names and other stocks primed to benefit most from the global economies reopening on a fresh wave of liquidity. This divergence renders a generalized view of the … Read more