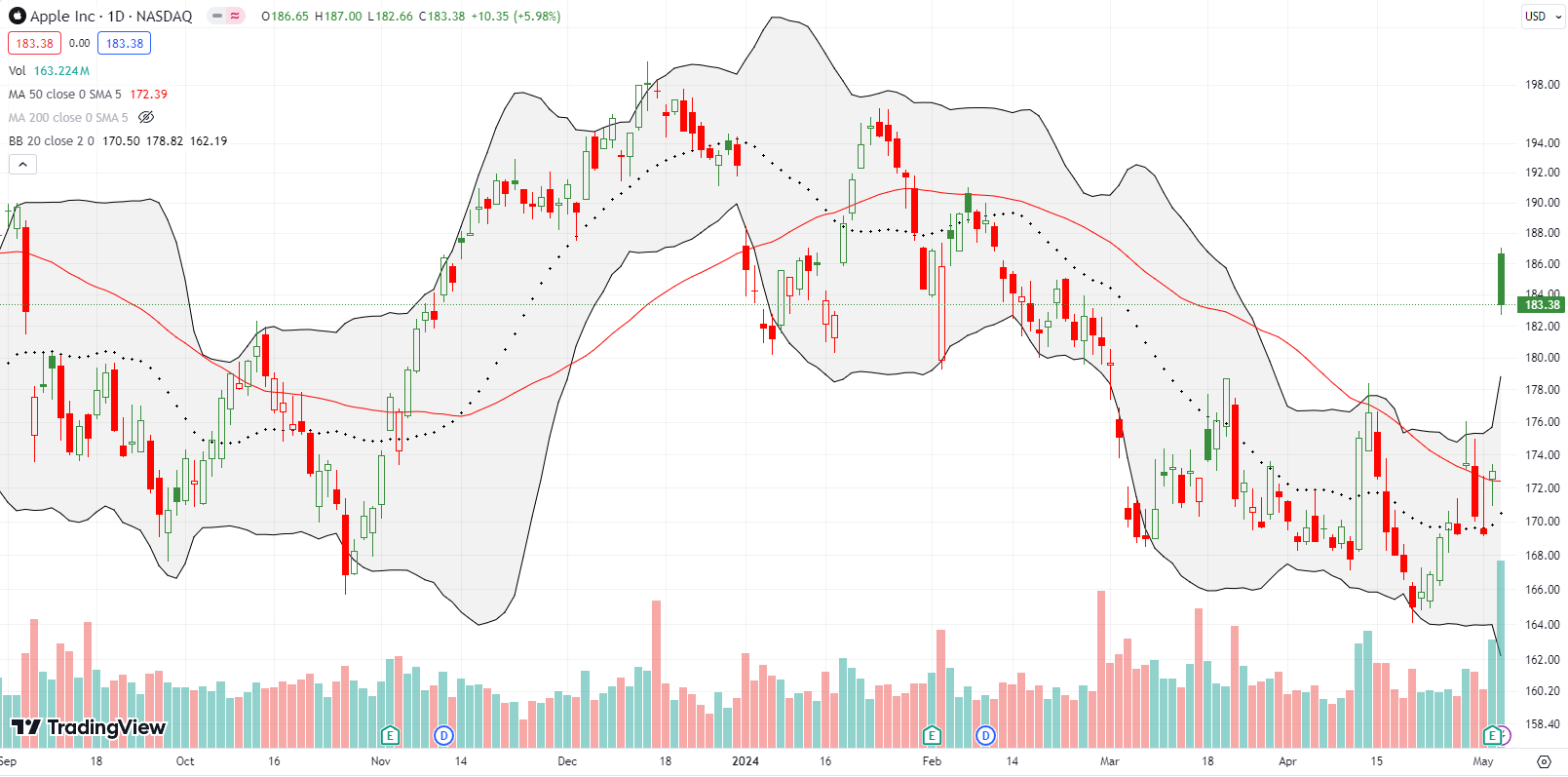

Not So Simple After Apple Buyquake Powers Market Through Failed Test – The Market Breadth

Stock Market Commentary In the prior week a post-earnings pricequake from Meta Platforms (META) dominated the stock market headlines. Last week, an Apple buyquake dominated the headlines and week-ending trading after the company announced a record $110B buyback. The subsequent gain in AAPL turned my simple test dividing bearish and bullish trading action into a … Read more