Bears Break In: Breadth Plunges Further Amid Economic and Political Shocks – The Market Breadth

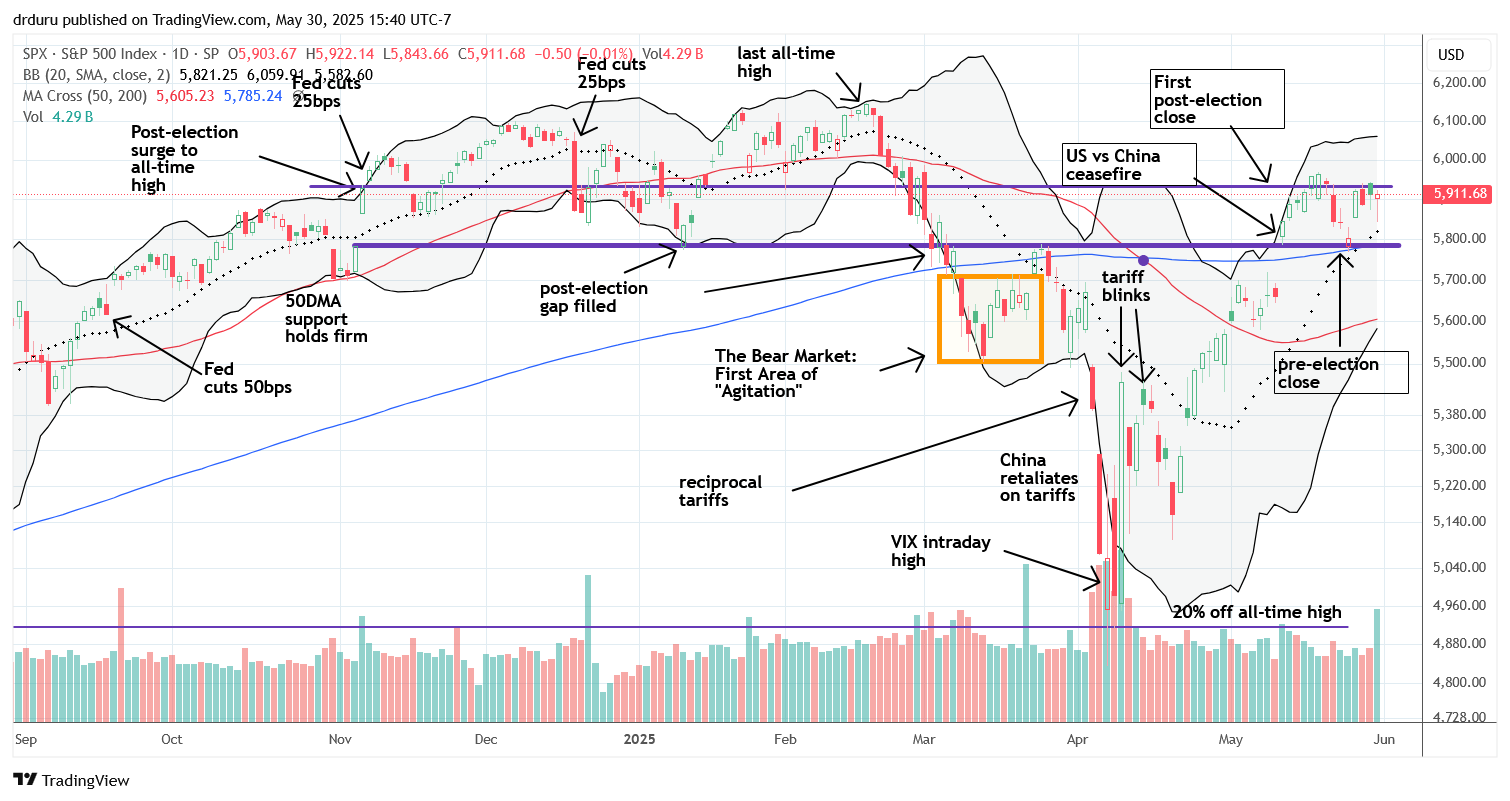

Stock Market Commentary Finally the bears break in on all the fun the bulls have had for months. The stock market got overwhelmed with a flood of bad news that was just too difficult to ignore or look through (for now). The July jobs report was not just weak but also it included a massive … Read more