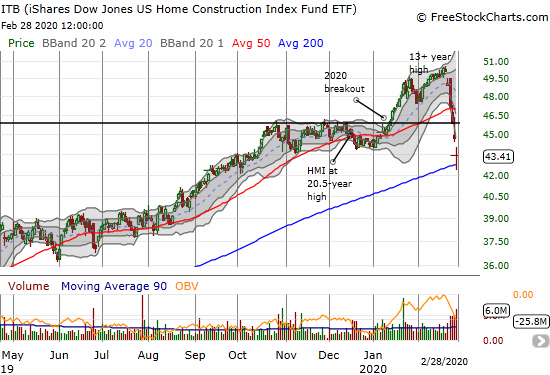

What Century Communities Said To Reignite the Home Builder Trade

“We are confident our positive trajectory will continue as not only did our fourth quarter net new contracts increase 45% over last year but we have seen our sales pace accelerate, with December up 54% and January increasing 77%. We are solidly positioned with a backlog of 3,439 sold homes, an increase of 66%, along … Read more