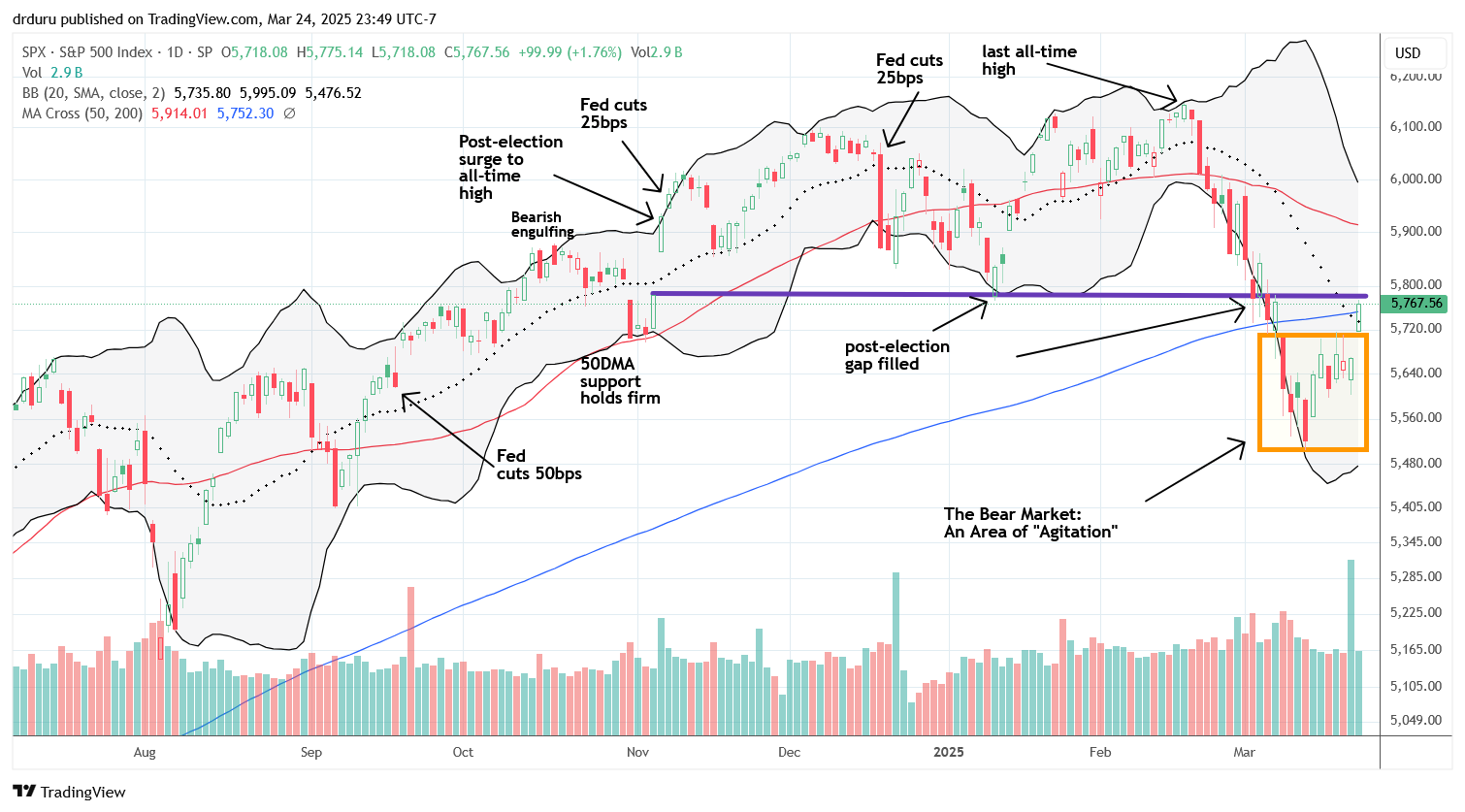

A Rolling Crash Deepens Oversold Conditions to New Extremes – The Market Breadth

Stock Market Commentary A good friend of mine introduced me to the phrase – now we’re cooking with gas! In today’s context, this phrase refers to some startling developments in the rolling crash in the stock market. The technical damage was thorough, unrelenting, and nearly merciless. Chaos in economic policy chaos has fully transferred into … Read more