Did NVIDIA’s Earnings Surge to All-Time Highs Trigger Stock Market Exhaustion? – The Market Breadth

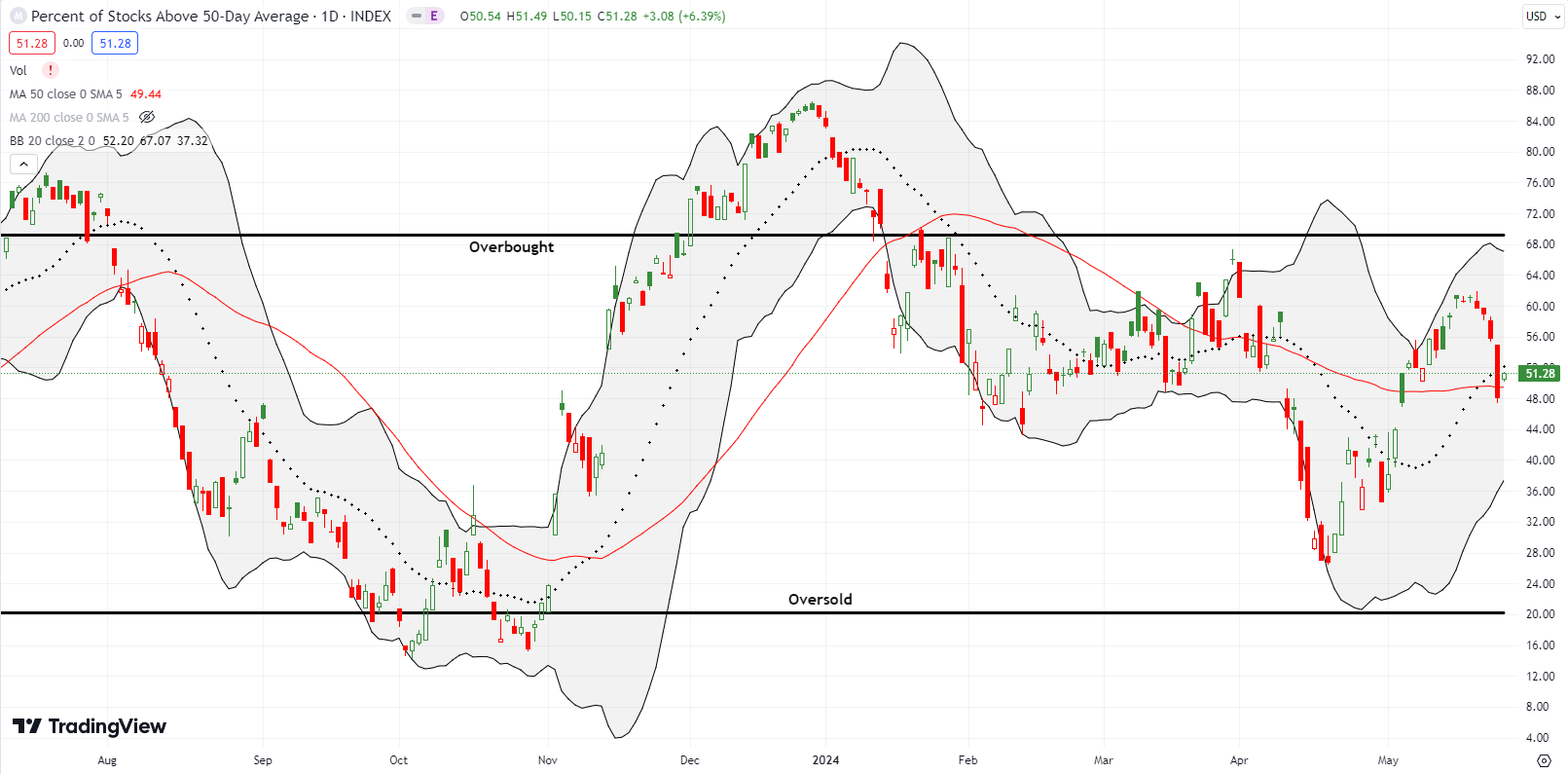

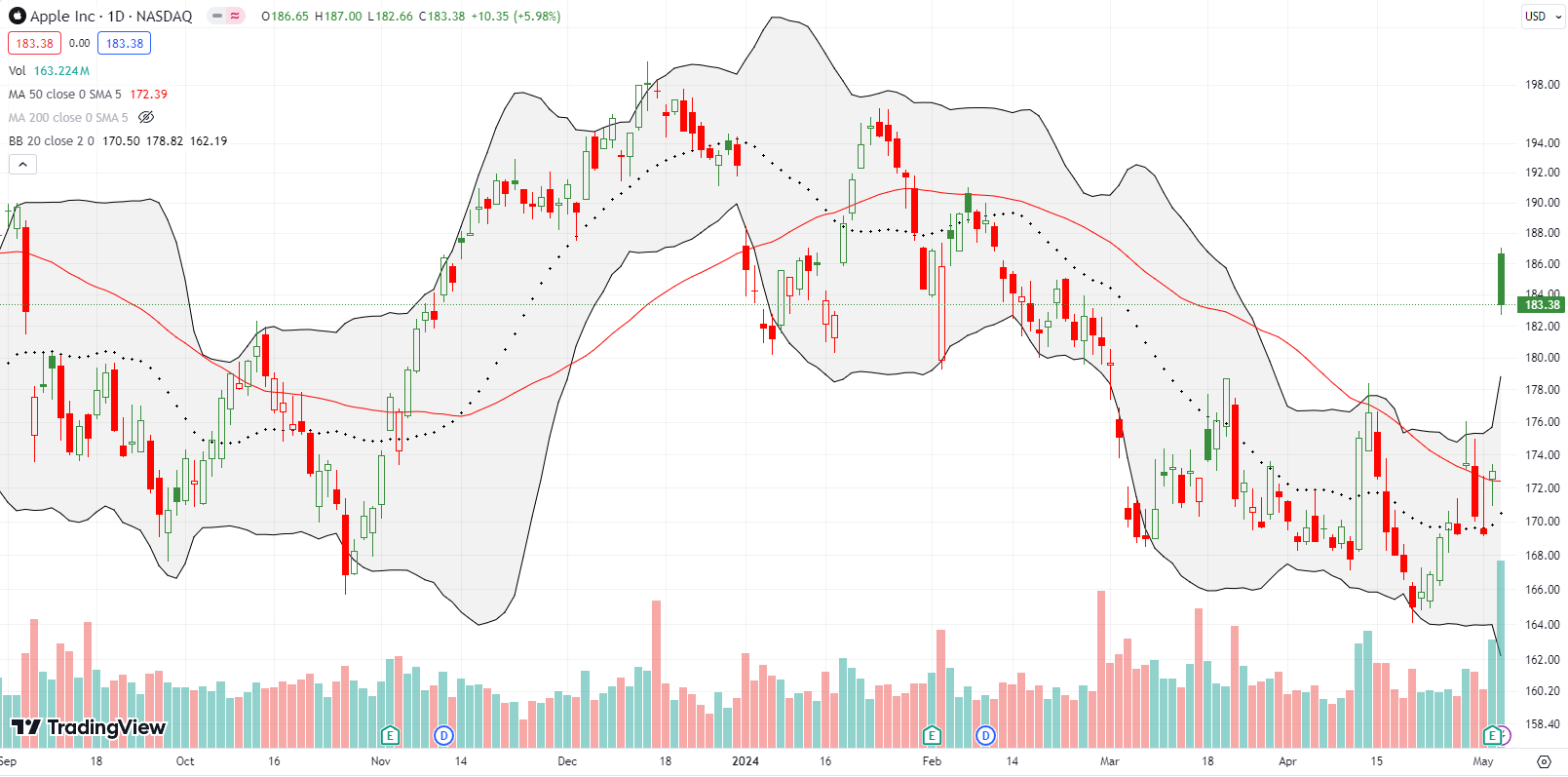

Stock Market Commentary I looked to last week’s earnings from NVIDIA Corporation (NVDA) with great anticipation. The indices gathered momentum with all-time highs and seemed to point to a big moment for NVDA. NVDA did indeed have a big moment, but it helped precious few. In fact, NVDA’s gain looked like a net loss. Buyer’s … Read more