A DeepSeek Dive and A Tariff Toll – The Market Breadth

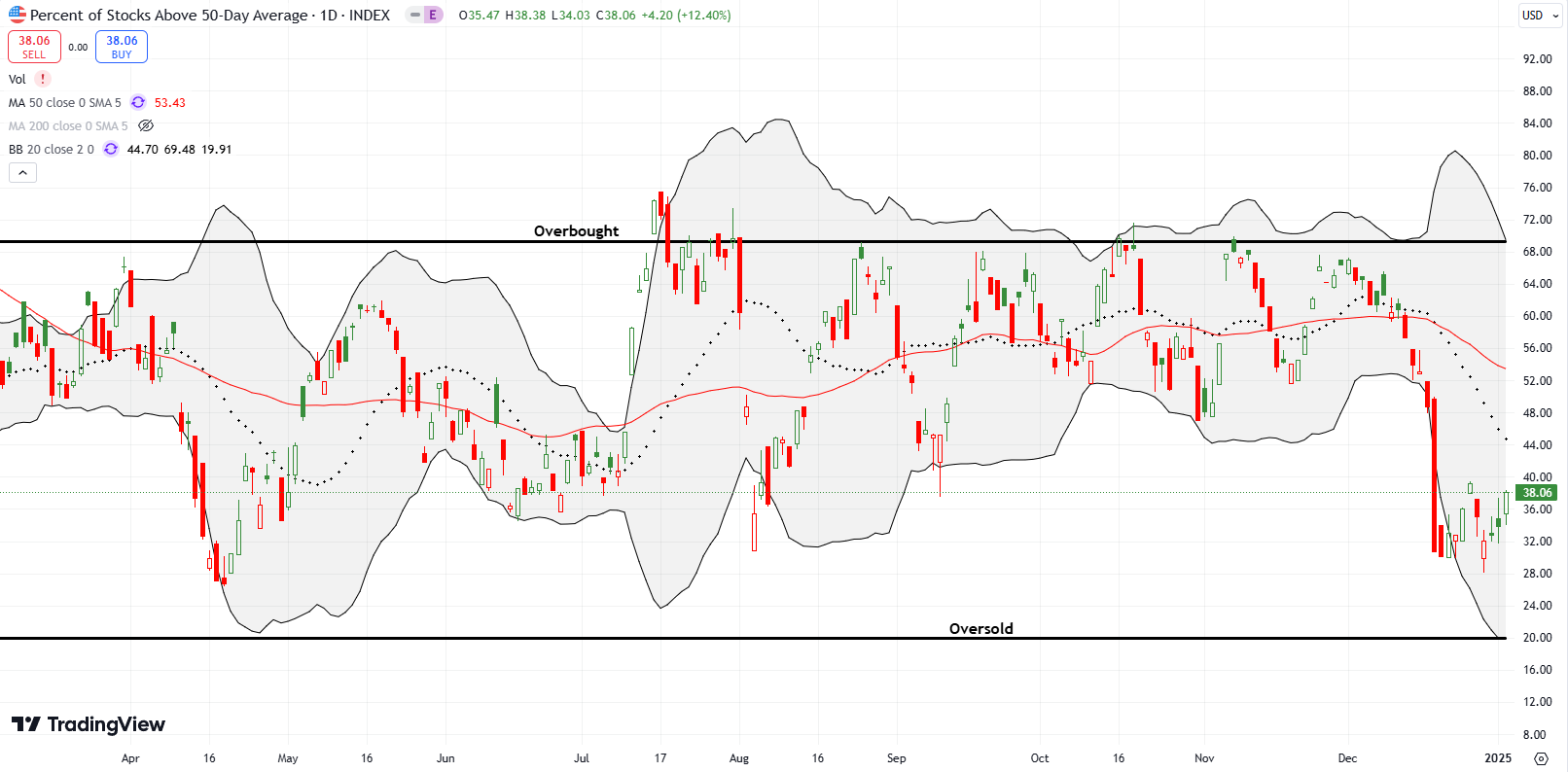

Stock Market Commentary A DeepSeek dive stole the headlines from the Federal Reserve. At the same time, tariff headlines refused to go away. Assuming you have already gotten your fill of DeepSeek headlines, I will just summarize the drama by saying a Chinese start-up has apparently completely up-ended the economics of the AI universe. DeepSeek’s … Read more