The conditions for bottoming in the ARK funds started to diverge a bit in late June. While the bottoming patterns differed, the ARK bottom synchronized with the general market’s bottom. Those conditions were born from the deeply oversold conditions that arrived in June. At that time, I interpreted the turmoil as the early days of a summer of discontent. Instead, the market slowly but surely became quite content to leave the June low’s behind. Still, the current ARK bottom validates my claim that sentiment was more important to understand than Cathie Wood’s macro and micro-economic analyses. Of all the economic context swirling around the case for speculating in the ARK funds, a peak in interest rates, and the associated expectations for a peak in inflation and a somewhat more amenable Federal Reserve, built the most compelling factor.

Interest rates topped out on June 14th. Looking backward, the path from there gives me the impression the market finally tired of trying to race ahead of the Federal Reserve’s rate hike cycle. A belief in “peak inflation” also helped. Here are the dates for the lowest close in each of the ARK funds and their respective relationships to the May lows.

- ARK Fintech Innovation ETF (ARKF): June 16th, 4.9% below the May closing low

- ARK Genomic Revolution ETF (ARKG): June 13th, 3.1% below the May closing low

- ARK Innovation ETF (ARKK): June 13th, 0.1% below the May closing low.

- ARK Autonomous Technology & Robotics ETF (ARKQ): June 16th, 0.5% above the May closing low

- ARK Next Generation Internet ETF (ARKW): June 16th, 3.1% below the May closing low

- ARK Space Exploration & Innovation ETF (ARKX): June 16th, 2.1% below the May closing low

For further reference, the S&P 500 (SPY) bottomed on June 16th, 6.0% below its May closing low. The NASDAQ (COMPQ) bottomed on June 16th, 5.5% below its May closing low. In other words, all these equities are moving in concert even if at different paces. The ARK bottom emphasizes how the ARK funds are just higher octane versions of performance relative to the stock market both to the upside and the downside (also known as “beta”). Note how sellers were mostly done beating up on the ARK funds by the May closing low while the stock market had more motivated sellers still left in the tank in June.

The Levels

ARK Fintech Innovation ETF (ARKF)

ARKF had a high threshold for confirming a bottom given it hit an all-time low in June. Slowly but surely, ARKF transitioned from failing at resistance from the former all-time low (set in the immediate wake of the pandemic) to pivoting around that line to breaking out above the June highs on August 3rd. Along the way, ARKF flashed subtle hints with slightly higher lows.

ARKF has mainly churned since the breakout. Still, I bought the small dip on Thursday in the form of August $22 calls. I like speculating on ARKF calls as long as it trades above the June highs. A close below the now uptrending 50-day moving average (DMA) (the red line below) invalidates my bullish read on ARKF. Such a breakdown would also imperil the ARK bottom for ARKF. Otherwise, I am targeting an eventual test of overhead 200DMA (the blue line below) resistance.

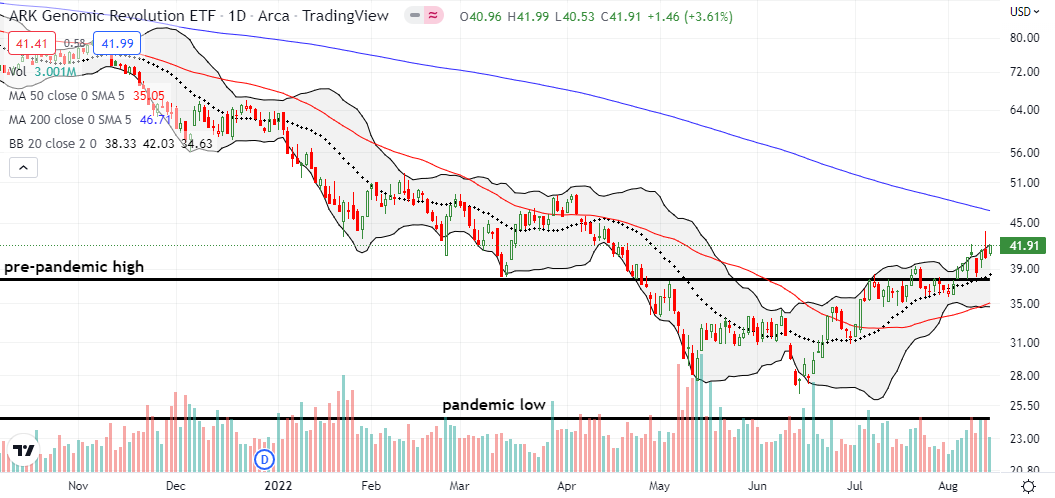

ARK Genomic Revolution ETF (ARKG)

ARKG made a more comfortable leap from its ARK bottom than ARKF. Sellers failed to press ARKG to its pandemic low before buyers took over. ARKG confirmed the bullish turn in events with a breakout above the pre-pandemic high. Along the way I flipped ARKG shares and am still holding an ARKG Oct $40/$50 call spread. I like buying ARKG shares on a dip back to the pre-pandemic high. While the uptrending 50DMA looks strong enough to provide sustained support, I think of the pre-pandemic high as more symbolically important as long as it rests above the 50DMA.

ARK Innovation ETF (ARKK)

The ARK bottom for ARKK was a “close enough” test of its pandemic low. That double-bottom set the stage for the current drift higher. The steady set of higher lows along the 20DMA (the dotted line below) has so far provided clear entry points for trades. My last trade was a weekly calendar spread at the $53 strike. The short side expired worthless as I hoped. I am now riding the long side for this coming week. I am interested in buying ARKK shares on a dip to the uptrending 50DMA. Below that I would brace for a true test of the pandemic low….and a new, lower bottom.

ARK Autonomous Technology & Robotics ETF (ARKQ)

The ARK Autonomous Technology & Robotics ETF (ARKQ) has enjoyed a relatively sharp streak higher since the July low. ARKQ is one of two funds whose ARK bottom took more than two tests. In fact, ARKQ carved out the rare quadruple bottom (stretching from May to July) before firming up for a sustained rally. I continue to hold a small amount of shares short as a partial hedge on my long ARK trades. I will close the short on a confirmed 200DMA breakout. If ARKQ breaks down below 50DMA support, I do not expect its ARK bottom to hold given the amount of pounding that bottom took over two months. Besides, relying on a quintuple bottom really feels like expecting a LOT during a fresh sell-off.

ARK Next Generation Internet ETF (ARKW)

The ARK Next Generation Internet ETF (ARKW) looks a lot like ARKK. ARKW did not quite get as close to its pandemic low as ARKK did before rallying. However, ARKW has the same characteristic subtle set of higher lows along the way to a confirming breakout above the June highs. I have yet to trade ARKW and see no need to do so given its near carbon copy behavior with ARKK. The pre-pandemic high and then the downtrending 200DMA will provide critical tests of buyer resolve.

ARK Space Exploration & Innovation ETF (ARKX)

Like ARKQ, the ARK Space Exploration & Innovation ETF (ARKX) has enjoyed a sharp rally higher since its July low. ARKX did not quite pull of a quadruple bottom as its ARK bottom given the last three tests of the bottom occurred notably below the May closing low. ARKX remains suspect from a technical basis given its shorter trading history and the sequence of all-time lows. Only a confirmed breakout above 200DMA resistance will put ARKX into consideration for me.

The Trade from the ARK Bottom

As a reminder, I turned bullish on ARKG and ARKK in late June and dropped my bearishness on ARKQ and ARKW. I was wary about ARKX and remain so now. The good news for all these funds is that their respective 50DMAs have changed from downtrends to uptrends. That turn in technical setup is by itself sufficient to claim a sunny assessment of the ARK bottom. By the same token, a confirmed breakdown below the 50DMAs will put this bottom in jeopardy for each of these funds.

As always, keep an eye on market breadth for clues on the unfolding technical context. Technical forces have pushed around and supported the ARK funds just as they do with other ETFs. Currently, an extended overbought rally is underway that should provide plenty of cushion for speculative plays like the ARK funds. The end of overbought trading conditions will create the first big decision point for trading from the ARK bottom.

Be careful out there!

Full disclosure: short ARKQ, long ARKF calls, long ARKK calls, long ARKG call spread, long TLT call spread