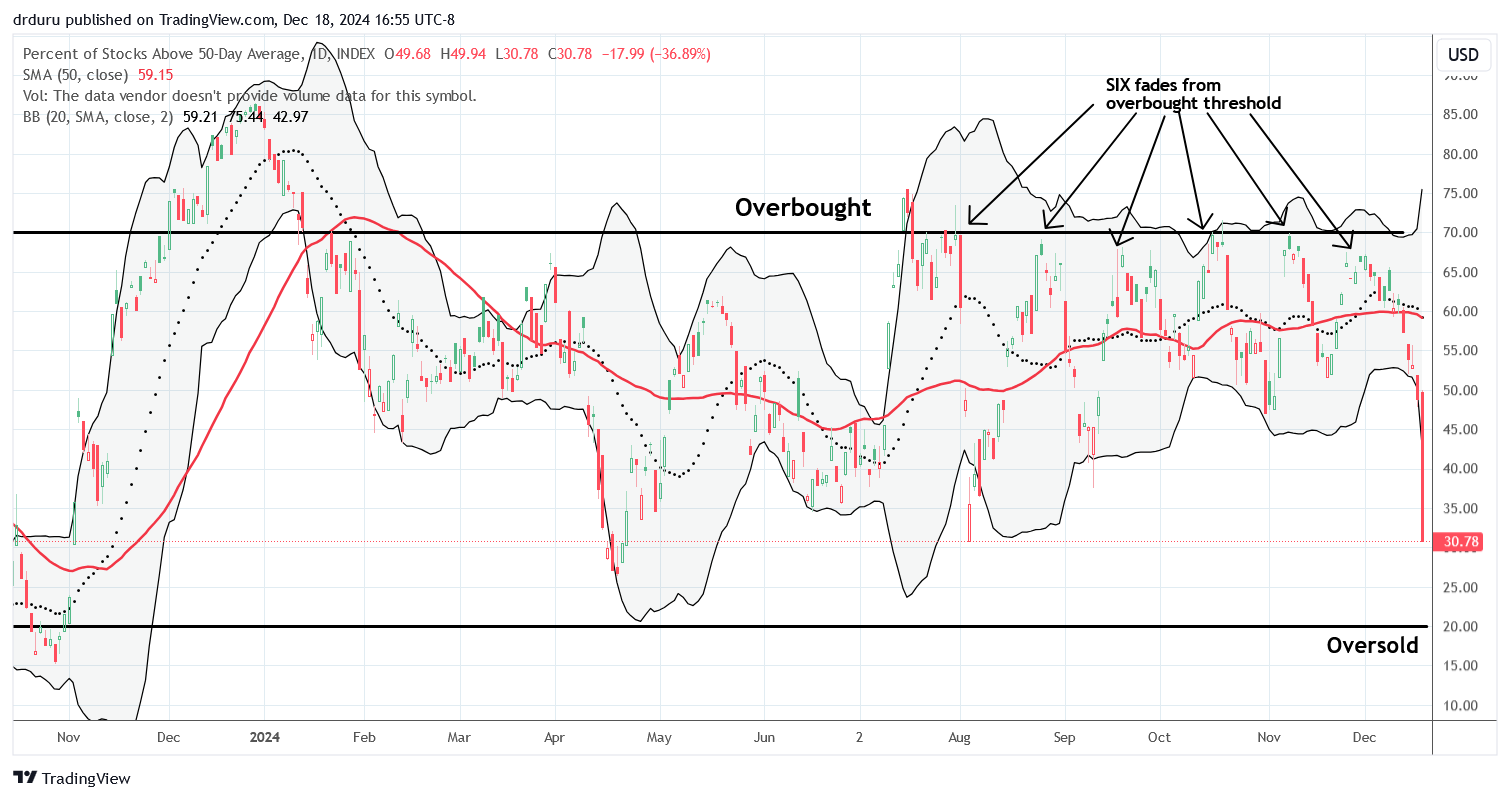

Still On Breadth’s Edge of A Breakdown – The Market Breadth

Stock Market Commentary The stock market started the week in familiar melt-up mode, supported by a (temporary) thaw in the economic war between the U.S. and China. Optimism persisted until the Federal Reserve weighed in with its latest announcement on monetary policy, when Chair Jerome Powell balked at the idea of a December rate cut. … Read more