A Test of the Stock Market’s Most Predictable Pattern – The Market Breadth

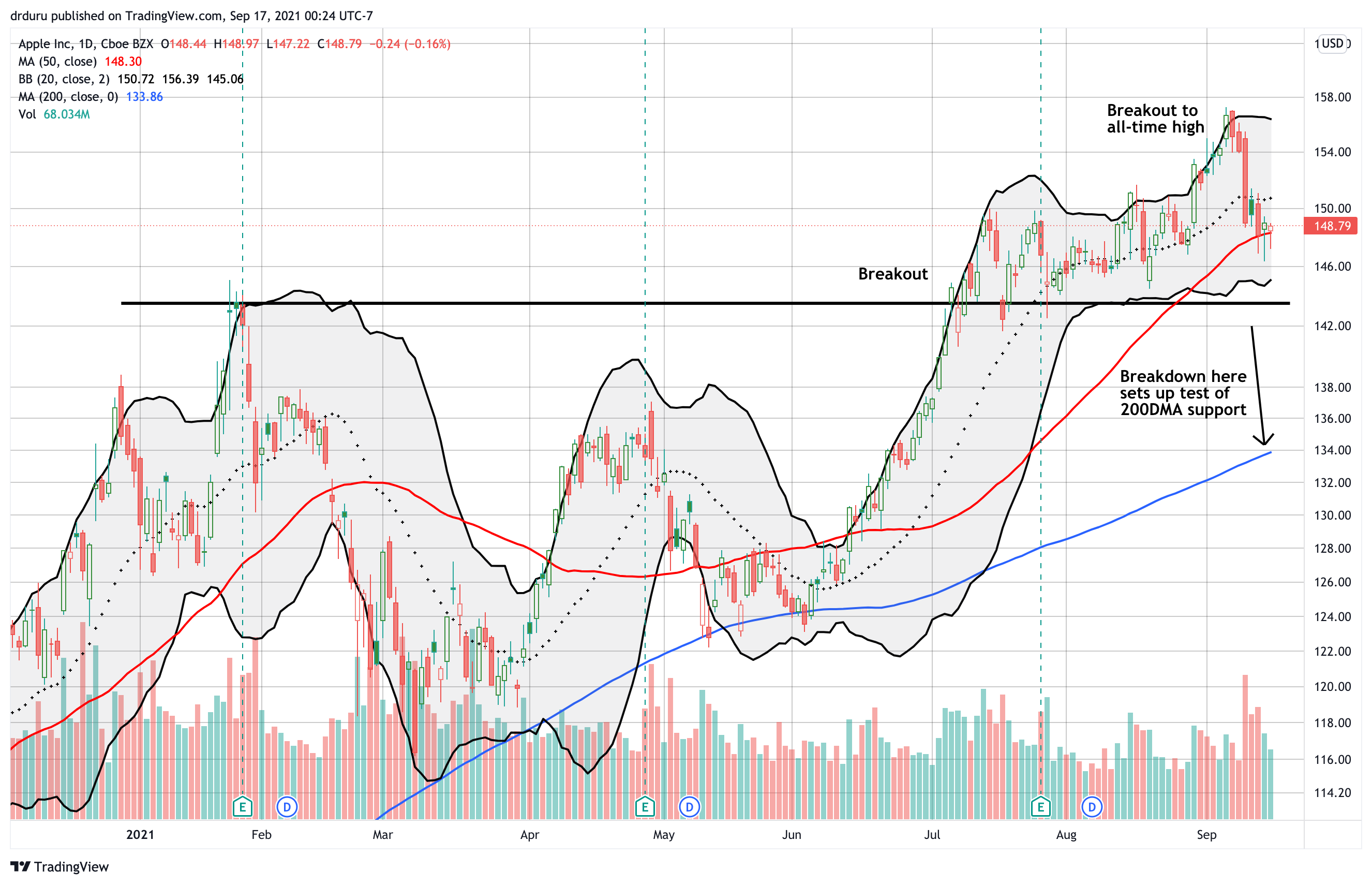

Stock Market Commentary The S&P 500 (SPY) is a key driver of the stock market’s most predictable pattern. The index’s relentless rise this year has held the majority of the trading action above the 20-day moving average (DMA) (the dotted line in the chart below). Brief dips below the 20DMA set up tests of the … Read more