Bottoming U.S. Dollar Ends Bargain Shopping in Mexican peso, South African rand

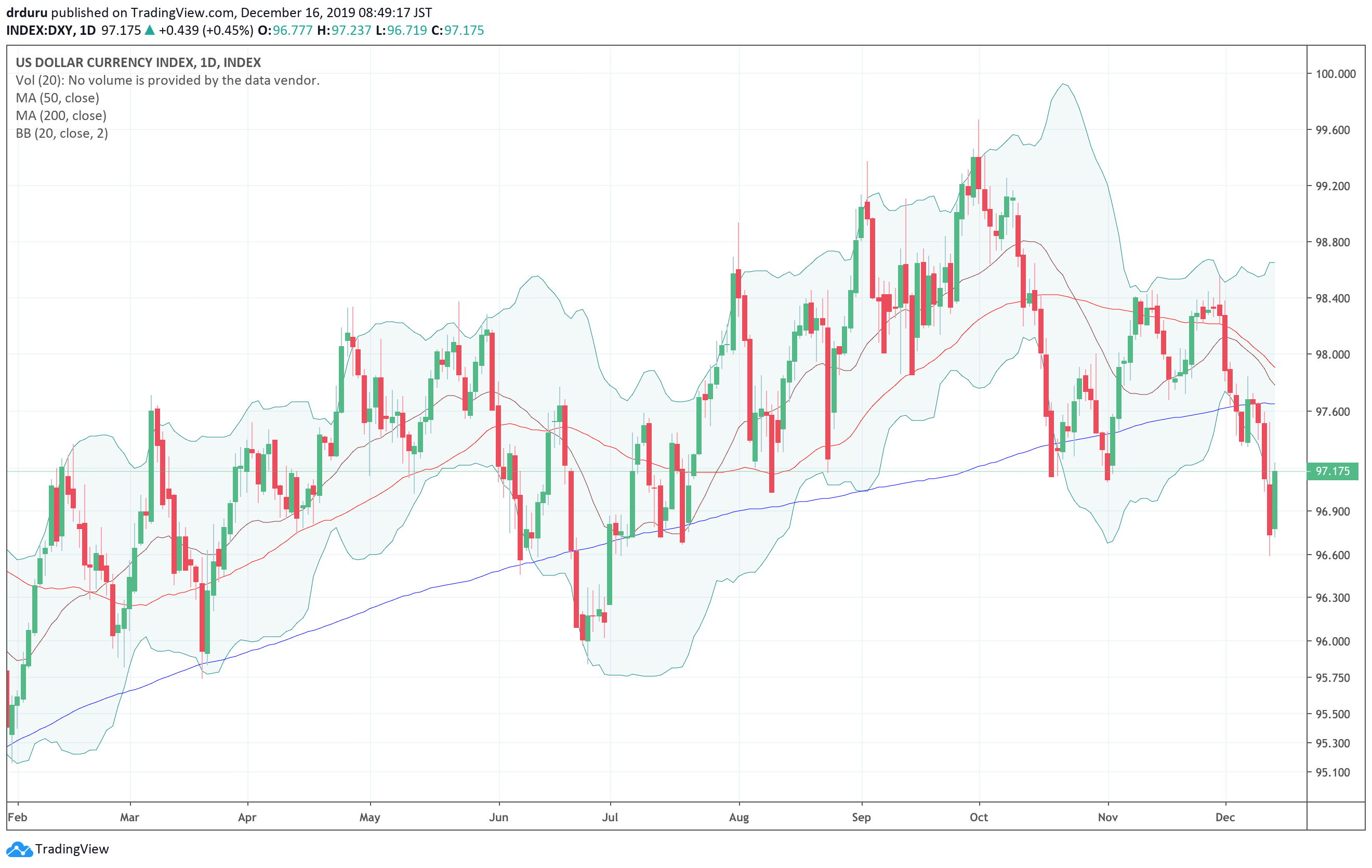

The U.S. dollar index (DXY) continues to pivot around its 200-day moving average (DMA). Last week, the U.S. dollar bounced before retesting the lows from March. The U.S. dollar now looks ready to challenge its 200DMA as resistance; it will likely complete another cycle by rallying at least to the previous highs above the 200DMA. … Read more