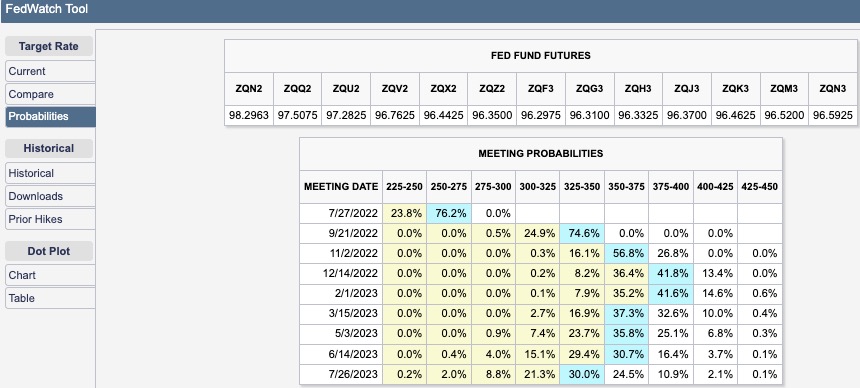

The landscape of inflation and monetary policy continues to change fast. The June inflation numbers disappointed expectations once again for peak inflation. A surprise 1% point rate hike by the Bank of Canada combined with this hot inflation accelerated the timeline for peak interest rates from the Federal Reserve. Instead of a 75 basis point hike for the July meeting, Fed Fund Futures are bracing for a Bank of Canada style 100 basis point move. This acceleration in turn pushed the peaking of 3.5% – 3.75% at the December, 2022 meeting, to a 3.75% – 4.0% peak rate range at the December meeting. However, instead of maintaining peak rates for 5 meetings before the first rate cut, the Fed Fund Futures have now priced in just two meetings at the peak before the first rate cut at the March, 2023 meeting. A second rate cut comes in July, 2023.

The U.S. Dollar Index

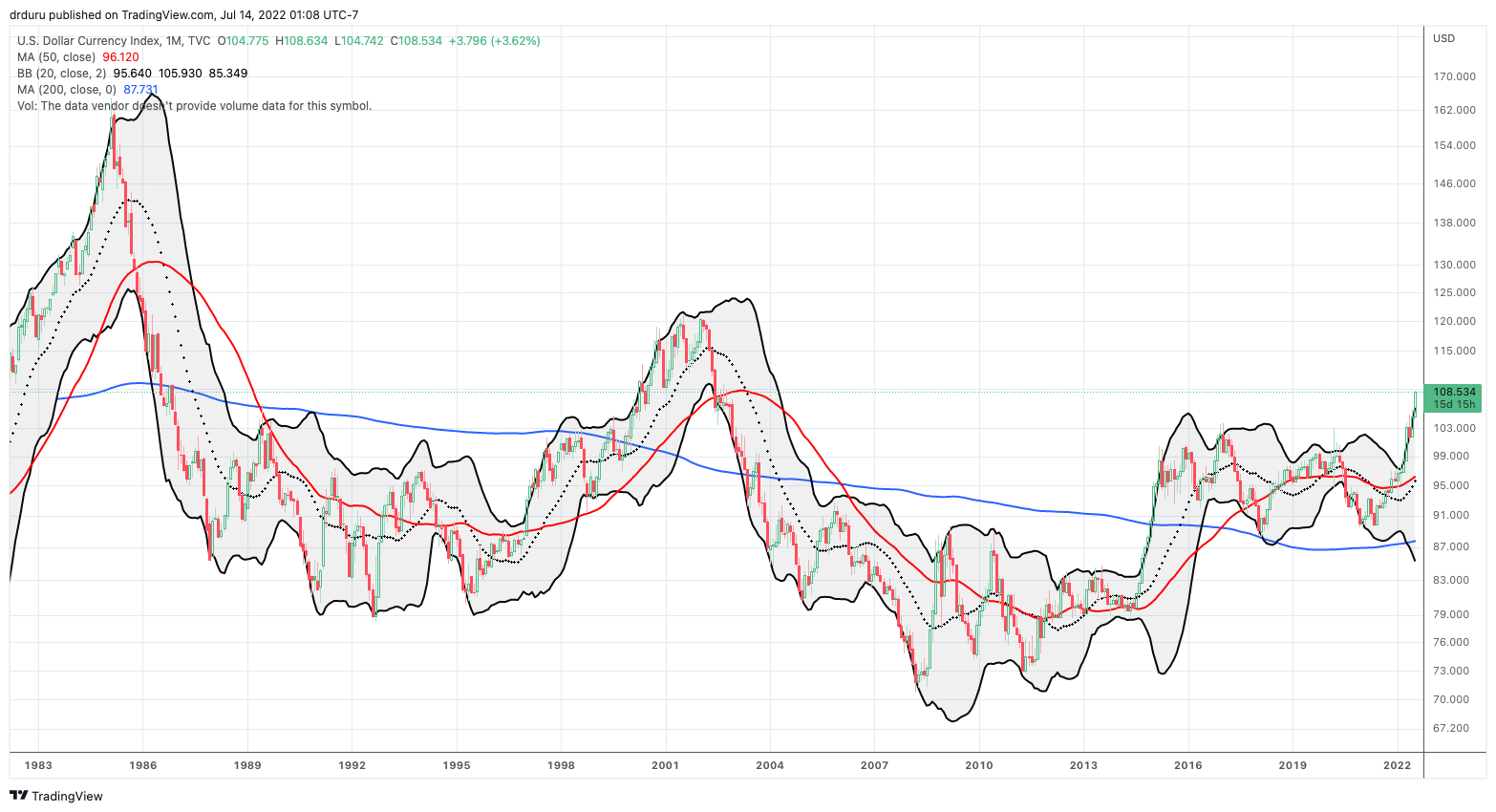

Given the shifting sands, this latest snapshot will not deliver the final word on the path of monetary policy. Yet, this is the map the market gets for now. Accordingly, the U.S. dollar index (DXY) gained fresh strength and momentum even as interest rates declined, presumably in response to rising fears of a recession. The monthly chart below shows how extended the U.S. dollar is, but also how much more room the dollar could go before hitting the next spot of resistance from the highs of 2001-2002.

I pared back my long U.S. dollar positions (long USD/JPY – which I think has a chance to get to 150 before the Bank of Japan finally acts). I plan to refresh on the next dip ahead of the Fed’s July meeting. I will go into the meeting dollar neutral and perhaps with no dollar positions period. The market’s response to the Fed could go in any direction depending on a multitude of possible policy stands from the Fed.

I am also keeping a close eye on gold. The SPDR Gold Trust (GLD) managed to gain 0.5% with a bullish engulfing print from the intraday low despite a fade from the intraday high. This nascent bottoming move needs a higher close for confirmation.

While financial markets can look forward to rate cuts sooner than before, the path to those rate cuts just got a little more painful. As a result, the ceiling on the stock market feels firmer than before.

Be careful out there!

Full disclosure: long GLD