A Hiccup in the Oversold Bounce from Weak GDP – The Market Breadth

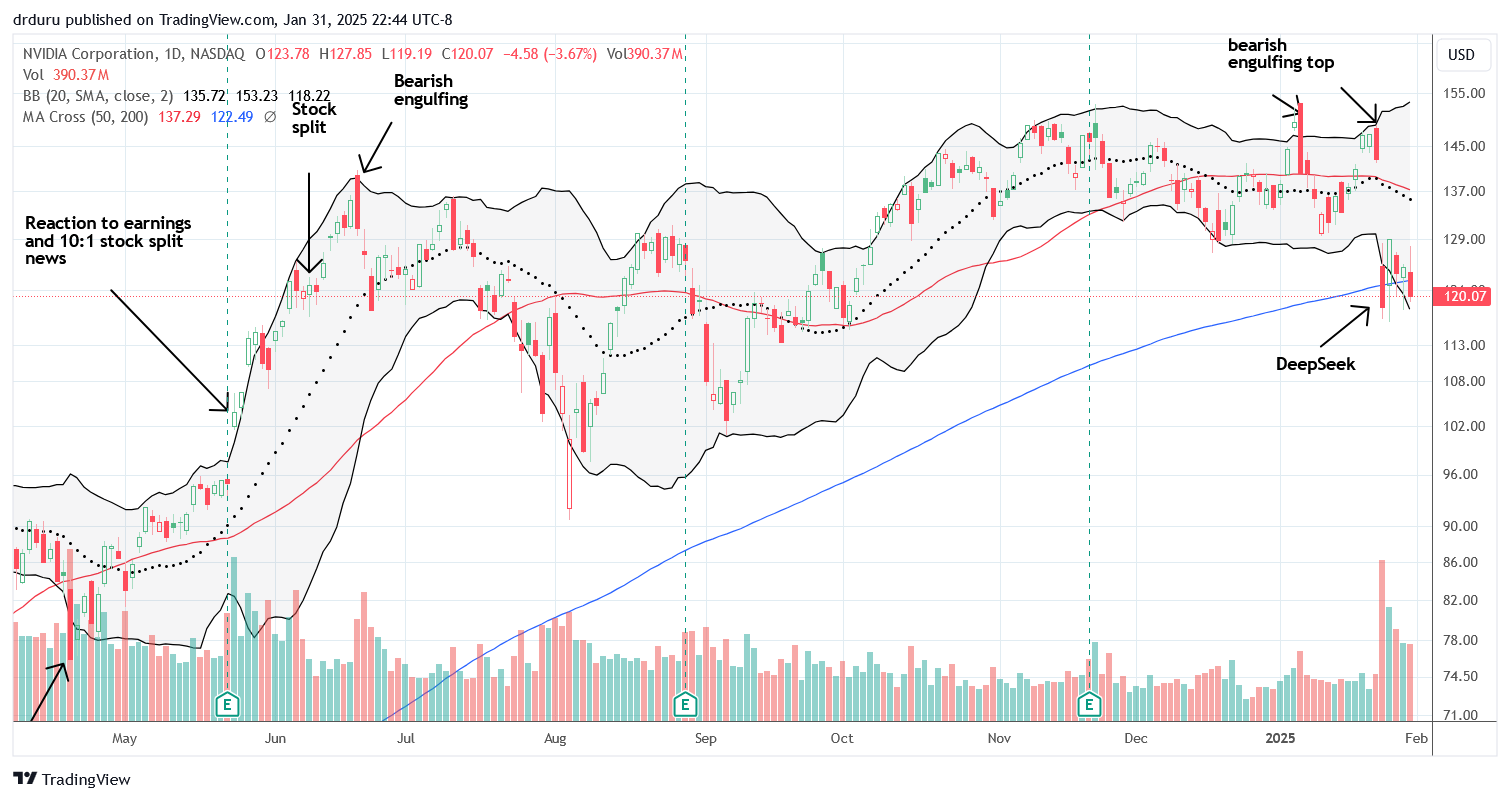

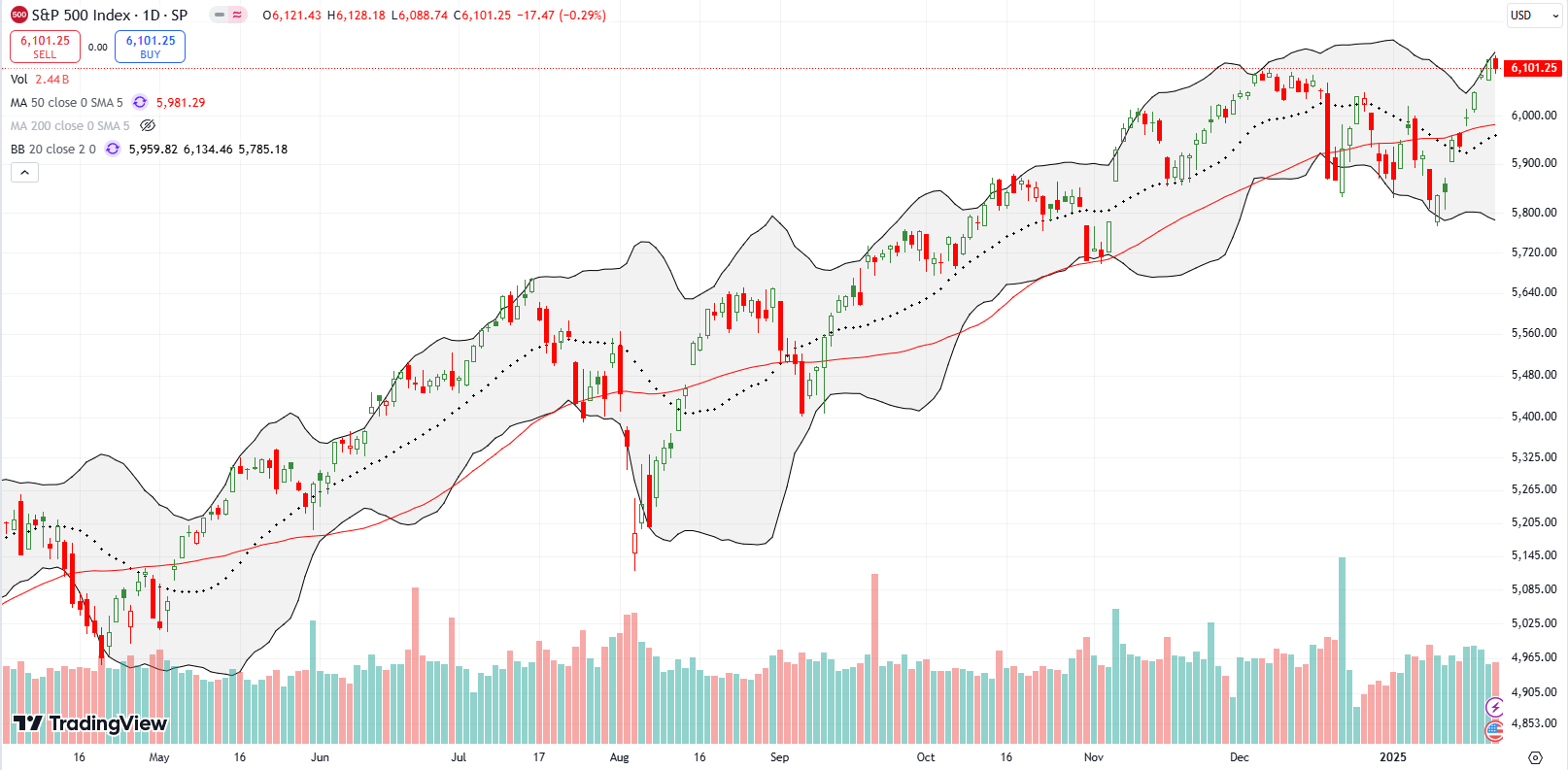

Stock Market Commentary The stock market experienced a hiccup in an otherwise strong post-oversold bounce. The Q1 GDP report revealed a small contraction that surprisingly caught the market off guard. However, this contraction was driven primarily by a surge in imports as businesses rushed to get ahead of anticipated tariffs. I assume a lot of … Read more