Q3 Takes the Q2 Baton of Notable Divergence – The Market Breadth

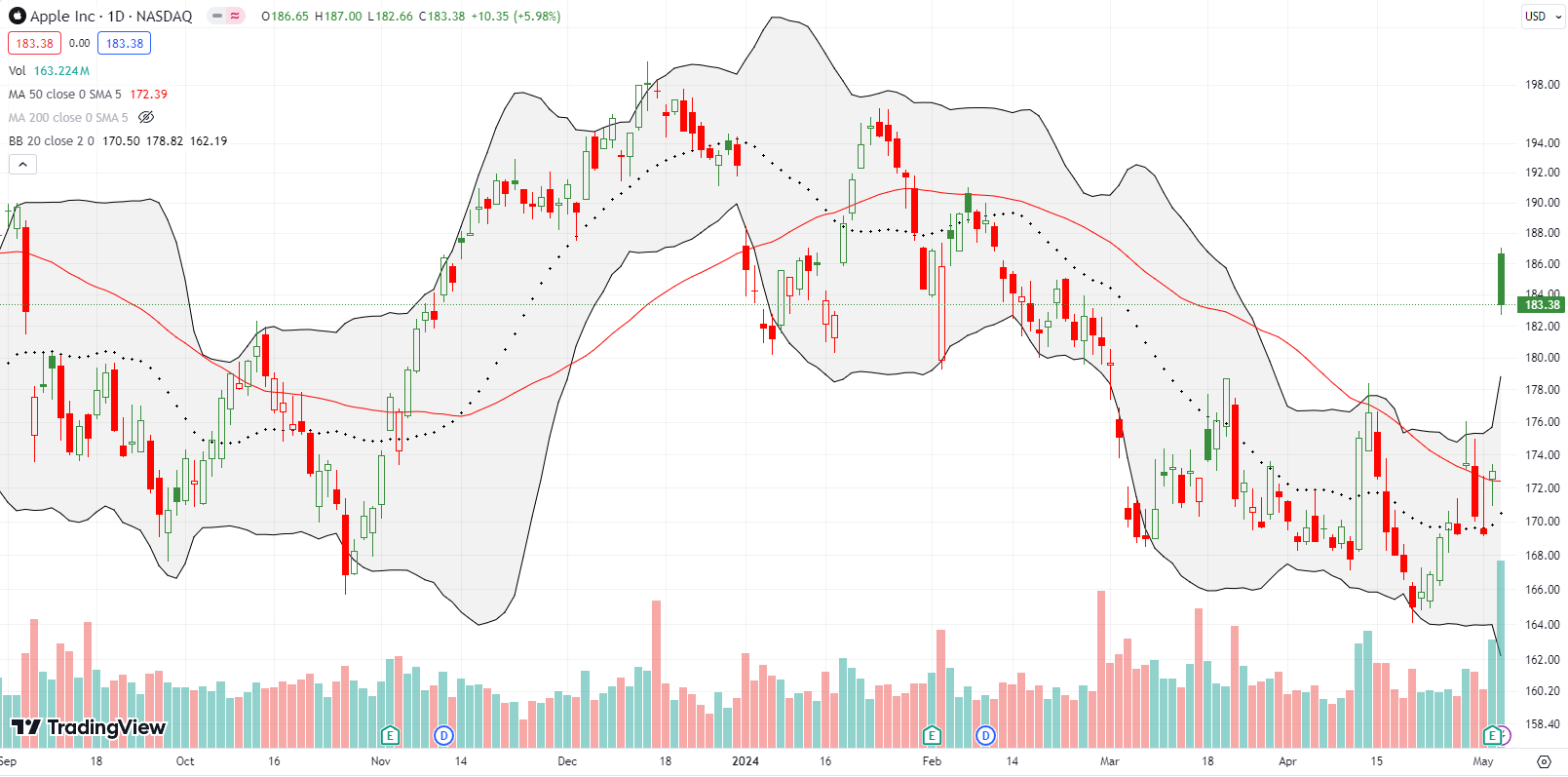

Stock Market Commentary The second quarter of the year ended with notable divergence. The third quarter picked up where the second quarter left off. Q3 took the Q2 baton of notable divergence, sending big cap stocks ever higher while leaving most of the market further behind. The jobs report seemed to be strong enough and … Read more