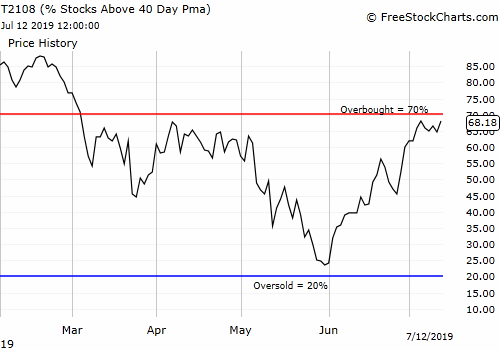

Rate Cut Cheer Not Yet Enough to Push Stock Market To Overbought – Above the 40 (July 12, 2019)

AT40 = 68.2% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 54.9% of stocks are trading above their respective 200DMAs (essentially matches the 2019 high and is a new 10-month high)VIX = 12.4Short-term Trading Call: neutral (caveats below) Stock Market Commentary After the report on June jobs, financial markets got … Read more