Market Rotation Looks Healthy… But Breadth Sent A Fresh Warning – The Market Breadth

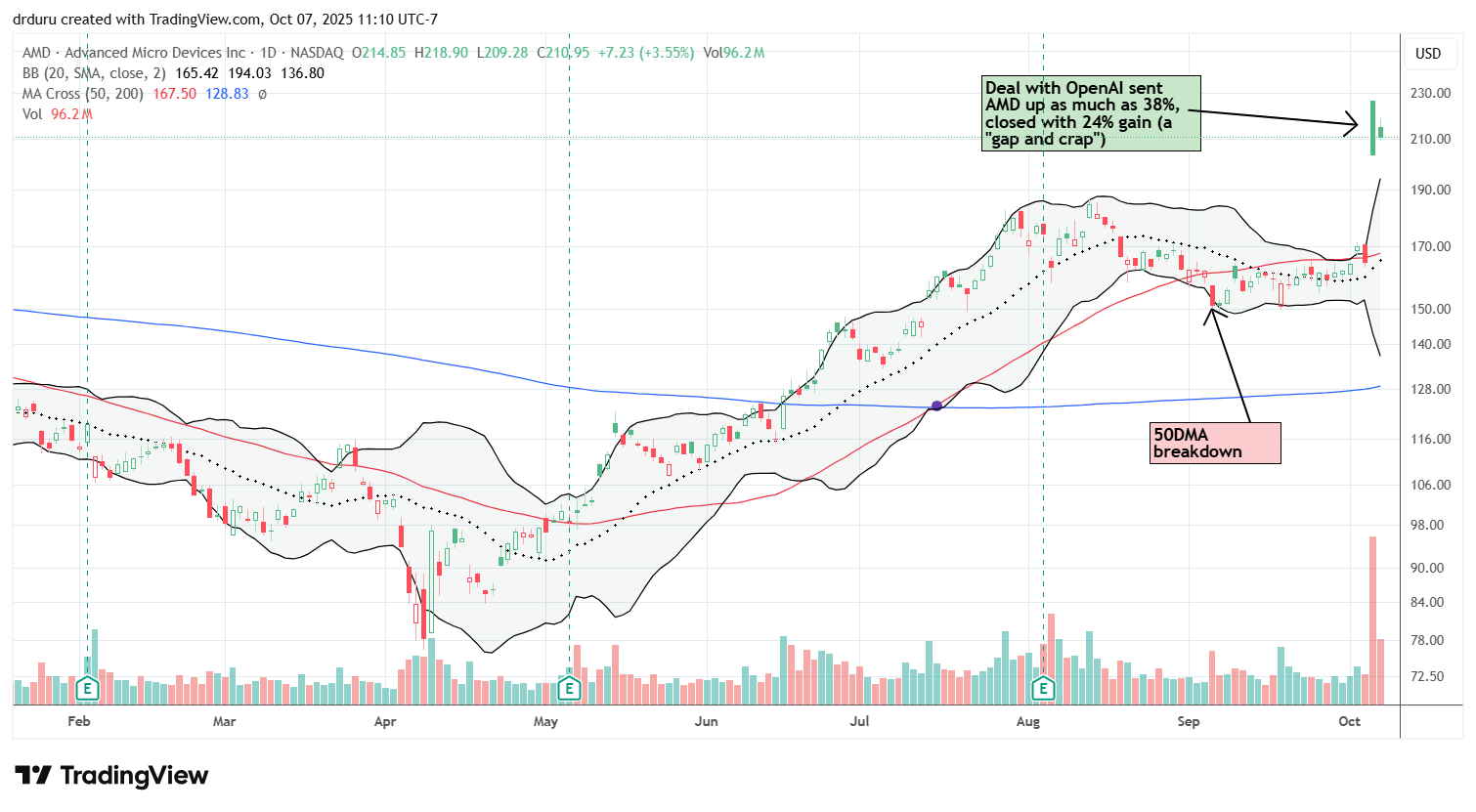

The Market Breadth Summary Market rotation is improving participation, but a fresh warning from market breadth keeps me cautious. Small caps and defensives are attracting capital while tech weakness quietly undermines leadership. I remain neutral after AT50 reversed from overbought levels, issuing a fresh warning despite bullish index trends. The disconnect between strong indices and … Read more