An Indicator of Stock Market Breadth Nears An Important Milestone

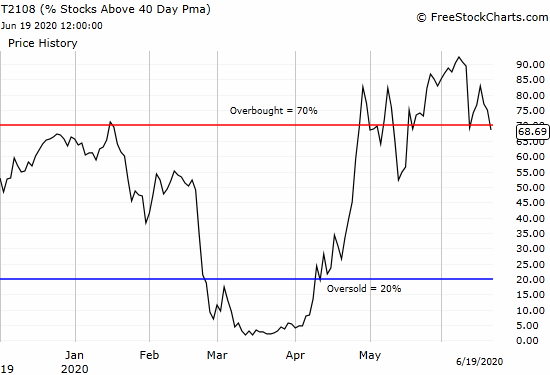

The stock market convincingly followed through on last week’s bullish divergence that indicated strengthening stock market breadth. At the time of the bullish divergence, AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), powered higher even as the S&P 500 (SPY) lost 1.0%. The index also suffered a 50DMA breakdown. … Read more