Getting Ready for the 2026 Stock Market – The Market Breadth

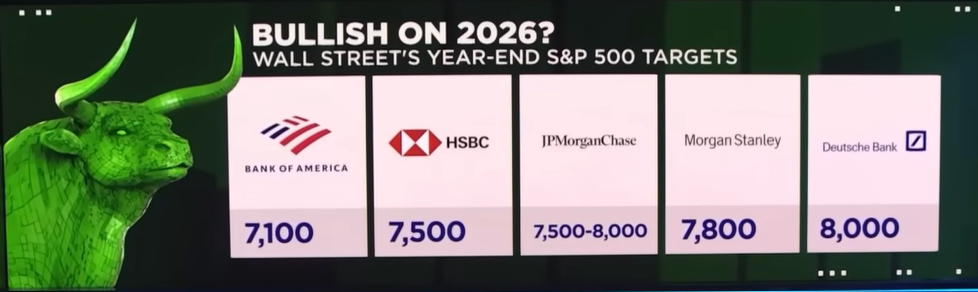

Stock Market Analysis Summary Markets are shifting as AI momentum fades, and Tom Lee’s outlook is pushing me to get ready for the 2026 market environment. Lee expects a conventional 10–15% correction in the first half of 2026, followed by a recovery as monetary policy turns more accommodative. Technical pressure is building: the S&P 500 … Read more