A Simple, Quiet Breakout for the Stock Market – The Market Breadth

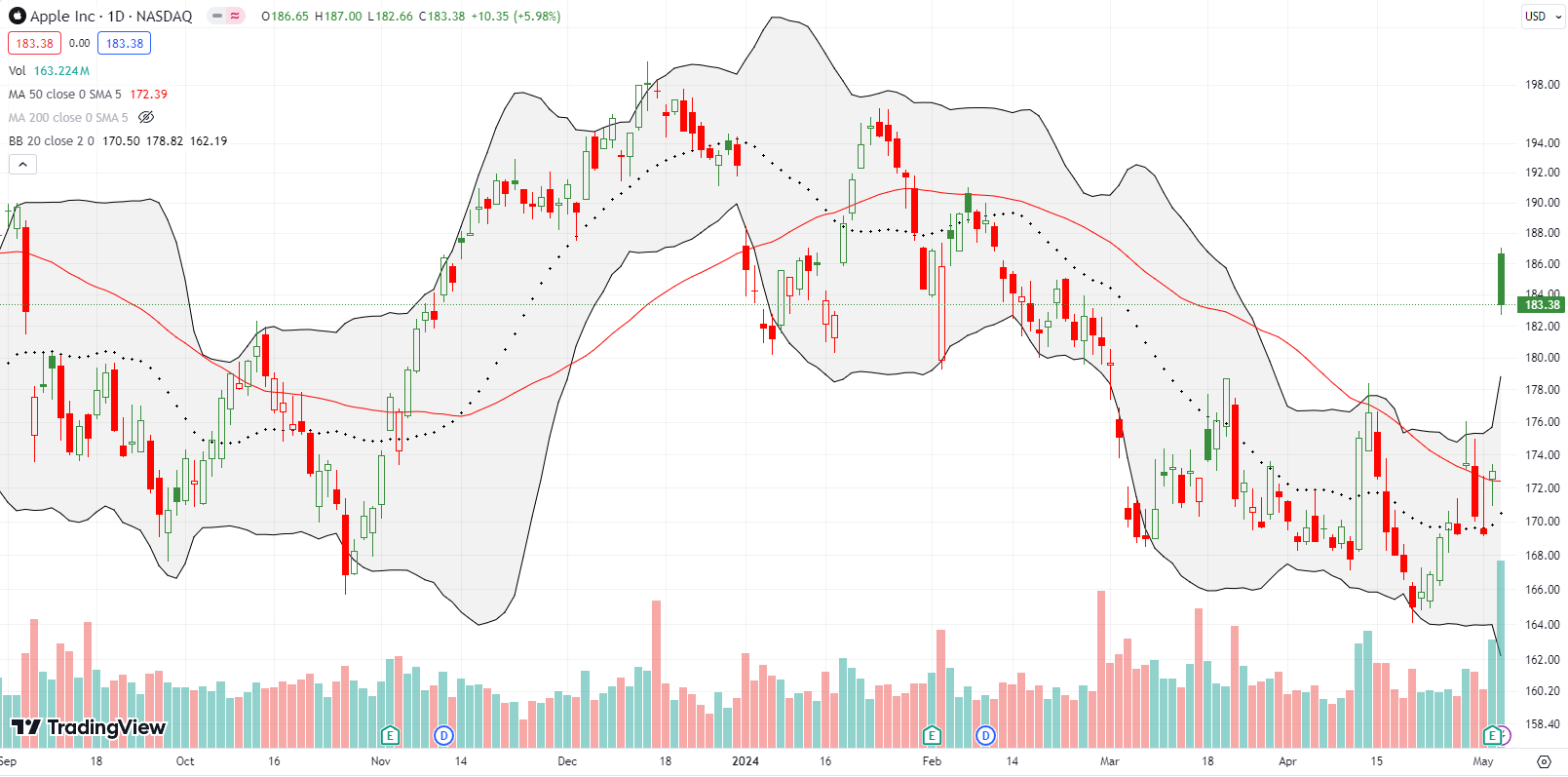

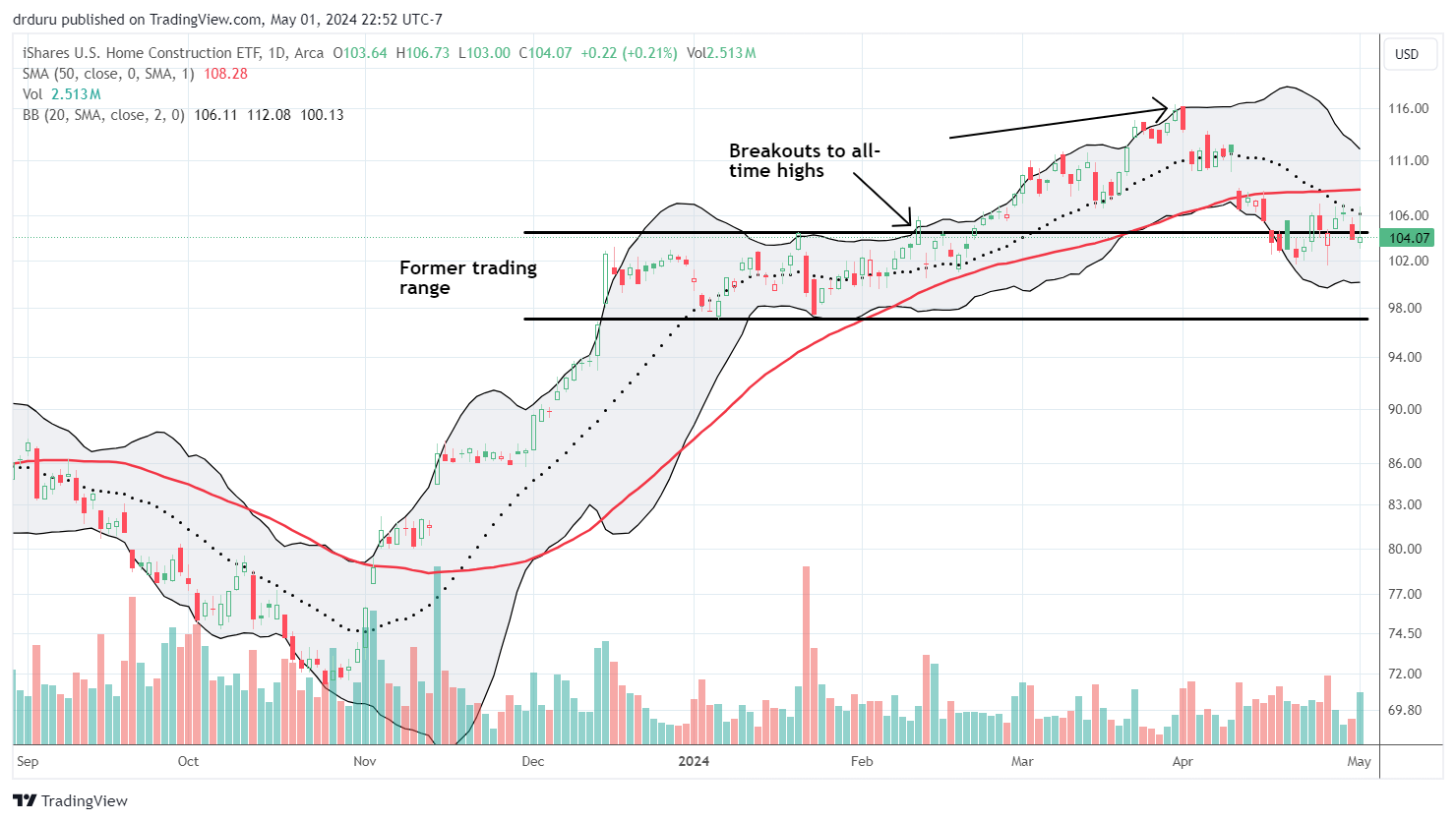

Stock Market Commentary I saw a simple test for distinguishing bearish and bullish signals after META’s post-earnings swoon last month. A quick rebound following failed tests at resistance complicated the picture. The price technicals and dynamics returned to simple as a synchronized yet quiet breakout unfolded last week across the S&P 500 and the NASDAQ. … Read more